Are You in Financial Alignment? Why being in financial alignment can make all the difference to your long-term goals.

Written by: Ryan Bouchey, CPA, CFP

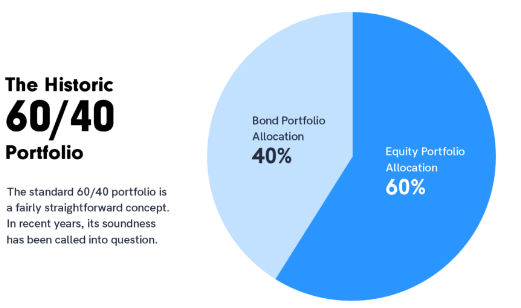

Maybe one of the simplest concepts in personal finance and investing, yet one of the hardest to stick to. It’s not for lack of trying. Everyone has heard about the 60/40 portfolio construction (and whether that’s right or wrong for today) it’s historically been a decent benchmark for most investors. Today’s blog is not geared towards the merits or whether the 60/40 portfolio is “dead” or right for you. This blog is meant to highlight how many investors lose sight of their allocation over time and how detrimental it could be, especially today.

What are the risks to a misaligned allocation?

Let’s run through the risks of today from not being in proper alignment:

Interest Rate Risk

This is a major risk at the moment, one we cannot ignore. How are you allocated as interest rates begin to rise? Is it hitting your accounts harder than most? We haven’t had to deal with interest rate risk in quite a while, close to 40-years in fact. The benchmark bond market just had its worst quarter in over 40 years. Yes, bonds offer diversification and usually act as the defensive portion of your portfolio, but making sure you have the right percent allocation and the correct holdings in your bond portfolio is critical in today's market environment.

Inflation Risk

Are you aware of the risks associated within your portfolio? Are you confident that your advisor has you aligned to deal with the market volatility this has brought on. What are you doing now and, in the future, to manage this risk?

Longevity Risk

We are living longer than ever. As technology and medicine continue to improve, this should only get better. Most retirees' biggest fear is running out of money. To compensate for this, they sometimes become too conservative thinking that this preserves their money. While it does preserve it in down markets, the market has historically gone up more than it goes down. With inflation recently hitting around 40-year highs, cash and cash equivalents won’t keep up. Is your portfolio stress-tested for longevity risk? Can you handle living 5, maybe 10 years or longer than you expected? These are legitimate concerns, and being in the wrong allocation could significantly impact a longer life expectancy.

Market Risk

This is easier said than done. Is your portfolio truly aligned with how much you are capable of losing in any given year? Most of us are loss averse, meaning we suffer the consequences of losses much greater than the joys of gains. There’s nothing wrong with this, it's literally hardwired into our brains. We’re supposed to act this way. However, when markets are soaring and everyone is seemingly getting rich like they were in 2021 it's much easier to overestimate what you can stand to lose. Or, in fact, you lose sight of it. Oftentimes, we tend to become much riskier at the wrong time (market highs) and risk averse on the down side. This is letting emotions get in the way of prudent management decisions.

Concentration Risk

I’ve had clients come in to discuss their portfolio and explain to me how they do not like to take on much risk and are more risk averse than the typical investor. When we work to onboard them, or discuss their allocation, we’ve found out they have 40-50% of their net worth tied up in one stock! No matter the type of company this is, this is the definition of risk! It’s so critical to understand how problematic this can be for your overall allocation and coming up with a tax and market efficient manner to unwind a position like this.

Liquidity Risk

When you need money, can you access it? Maybe you can access it, but can you access it without penalty and fees? Also, are you aligning your liquidity needs with your tax situation? Are you best positioned to take advantage of changing tax rules and rates? These are all questions to be sure you can answer as you set up your portfolio allocations, knowing how each piece fits in with the others. Having the liquidity needs and setting it up tax efficiently can save you and your loved ones a lot of money in the long run.

Financial Goal Risk

This is one of the biggest disconnects we see with allocation misalignment. When your allocation isn’t aligned with your financial, and / or life goals, then your money isn’t working for you. We try to build purposeful wealth with our clients. It’s obvious from that statement but looking at each area of your financial life to make sure it has a purpose, and it serves a purpose for you and your family. This is so important to get right, and oftentimes is overlooked. Planning can help alleviate this risk.

Risk of the Unknown

How does this present itself? One in three ways:

Not knowing what you're invested in. Let’s take a look at a pretty popular 401(k) strategy. In most cases, having a Target Date fund in a 401(k) plan isn’t the worst option. It gives you diversification and allows you to essentially “ride” the market. But have you ever looked under the hood? Take a 60-year old worker, who may choose a 2025 Target date fund. I took a look at Vanguard Target 2025 fund for this. The allocation breakdown is 45% Bonds & Cash / 33% U.S. Equities / 22% Foreign equities. For someone in their early 60’s, this is a TERRIBLE allocation. Having close to 50% in bonds / cash in this type of market environment could be very detrimental to the long-term goals and life expectancy of someone this age. Even though this may have felt like the smart choice for a fund, it could very negatively impact their financial situation.

Having too many accounts spread out. Consolidating accounts is so important, especially in retirement. It can be really hard to track multiple accounts that have no true purpose, and have a wide range of allocations. While on their own they may all seem relatively aligned with your goals, unless you are looking at them in aggregate it could be very difficult to manage. Whether it’s too much risk or too little risk, many accounts without a plan can misalign your goals with your investments and you may not even know it.

Not having a plan. The easiest way to align financial goals with your investment allocation is to have a plan. Being super intentional about what you hold and what you want to accomplish is critical. Not only does it help with being purposeful about your wealth, it gives you confidence during uncertain times. This may be the biggest benefit of it all. I can’t tell you how much peace of mind clients who have a plan have versus folks who don’t have a plan.

It’s much easier to overlook some of these misalignments than you think. Trust me, you are not alone if you feel you may be at risk.

Allocation misalignment may not mean doom and gloom. Your retirement may not suffer and you will continue to build wealth. But you won’t be as intentional as you could be building your wealth. You may be taking on more risk than you realize or that you're comfortable with. Or you may be falling short on some meaningful financial goals that may not affect you, but could affect your family and loved ones. Creating financial alignment through proper allocation won’t just give you financial peace of mind, it will give you the meaningful wealth you are trying to create.

If you have questions or would like to discuss your current financial alignment, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.