A Turning Point for the Dollar?

Written by: Martin Shields, CFP®, AIF®

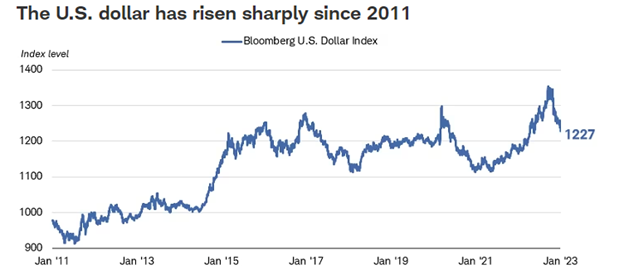

For the past decade, the U.S. Dollar has experienced a sustained rally against other currencies with gains of almost 50% from its lows of 2011. These gains were propelled by the resilience of the U.S. economy, relatively high interest rates compared to other developed countries and a safe haven amid global politics.

This article will discuss:

- U.S. Dollar outperformance since 2011

- U.S. assets outperformance of Global assets over the past decade

- Is the dollar going to lose its status as the global reserve and trade currency?

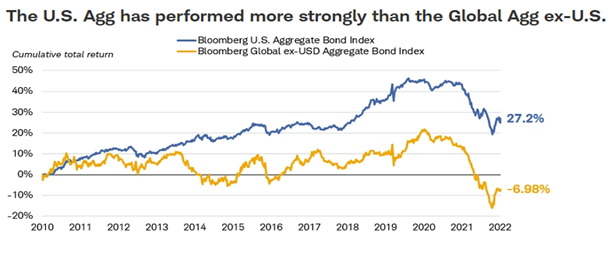

This long trend of outperformance of the greenback is an important factor behind the outperformance of U.S. investment assets to international assets. From a historical perspective, it is common for US and international assets to have extended periods of outperformance, but this has been one of the longest periods of US. dominance. And, as shown in the exhibit below, this strength was not only in stocks but also bonds.

As we have started 2023, the U.S. Dollar has declined by approximately 8% against this basket of global currencies and expectations are beginning to form that this trend could continue as the Federal Reserve’s rate increases may be coming to an end. Even with the decline from its peak that it hit in September of 2022, the dollar valuation is still elevated from a historic perspective, and it would have to decline by another 20% to bring its valuation in line with historical averages.

As with most areas of global economics, there are both pros and cons if the dollar continues to weaken.

- The pros are U.S. company profits from international sales would most likely increases as their prices would now be more competitive versus their international counter parts. Also, when their profits earned overseas are converted back to dollars they would be converted at a higher rate.

- The downside to a weaker dollar is higher prices for consumers and for manufacturers of goods purchased from other countries.

As an investor, a weaker dollar would potentially make international assets more appealing, especially after an extended period of underperformance. From a consumer perspective, international travel may start to look a little more expensive than it has, and goods produced in the U.S. may be come more attractive.

It is important to point out that there have been other times over the past decade that it appeared the U.S. dollar might be declining versus foreign currencies, and it didn’t happen so it is certainly possible that this may be another false start to a declining dollar trend.

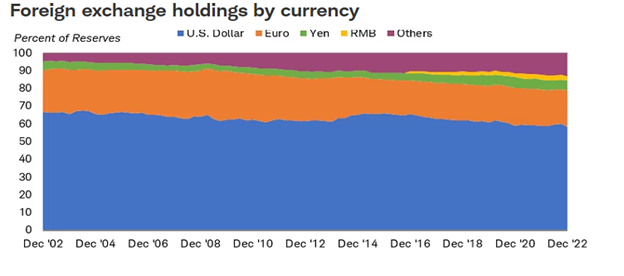

One of the questions we receive frequently is whether the dollar is going to lose its status as the global reserve and trade currency. As is shown in the graph below, over the past 20 years, the dollar’s global reserve dominance has declined slightly. This trend will most likely continue but it will continue at a very slow rate and the dollar will still be the dominant currency even as other currencies take on a more important role.

If you have any questions regarding this topic or any other investment areas, please feel free to contact Bouchey Financial Group to discuss in more detail.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, Massachusetts.