2024 Inflation Adjustments: Retirement Plans, Social Security, and Medicare

Written by: Nicole Gobel CPA, CDFA

Inflation is not in and of itself negative as we would expect a reasonable increase in all areas over time. Discussions over the last couple years on this topic have often centered around the higher cost of goods, services and housing, and how it has affected the average household or business. We have seen significant wage inflation and continued low unemployment, but many individuals feel this has not offset higher prices. The good news is that some inflation adjustments are positive in that they allow for individuals to:

- Save more for Retirement

- Receive more in Social Security Benefits

- Have a higher income before having to pay Medicare premiums surcharges (IRMAA)

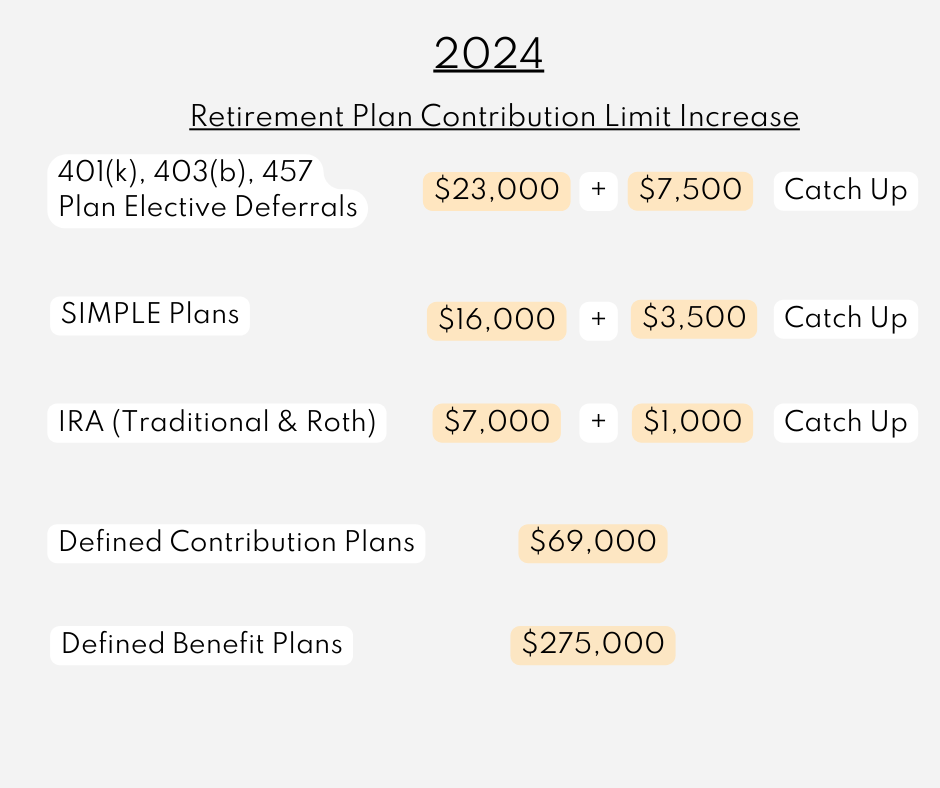

Retirement Plan Contribution Limits Increase

On November 1st, the Internal Revenue Service announced changes to the contribution limits for retirement plans in 2024. Employees who contribute to 401(k), 403(b) as well as government qualified retirement plans can contribute up to $23,000 for 2024, an increase of $500. However, the catch-up contribution for those over age 50 remained at $7,500. The total combined amount that you can contribute to a 401(k) or other defined contribution plan increased from $66,000 to $69,000 allowing for higher employer contributions. SIMPLE IRA contributions also increased $500 to $16,000 while catch-up contributions remained at $3,500.

Traditional and Roth IRA contributions increased $500 to $7,000. Catch-up contributions remained at $1,000. The income phase-out range for Roth IRA contributions for 2024 has increased to $230,000 to $240,000 for married couples or $146,000 to $161,000 for single filers.

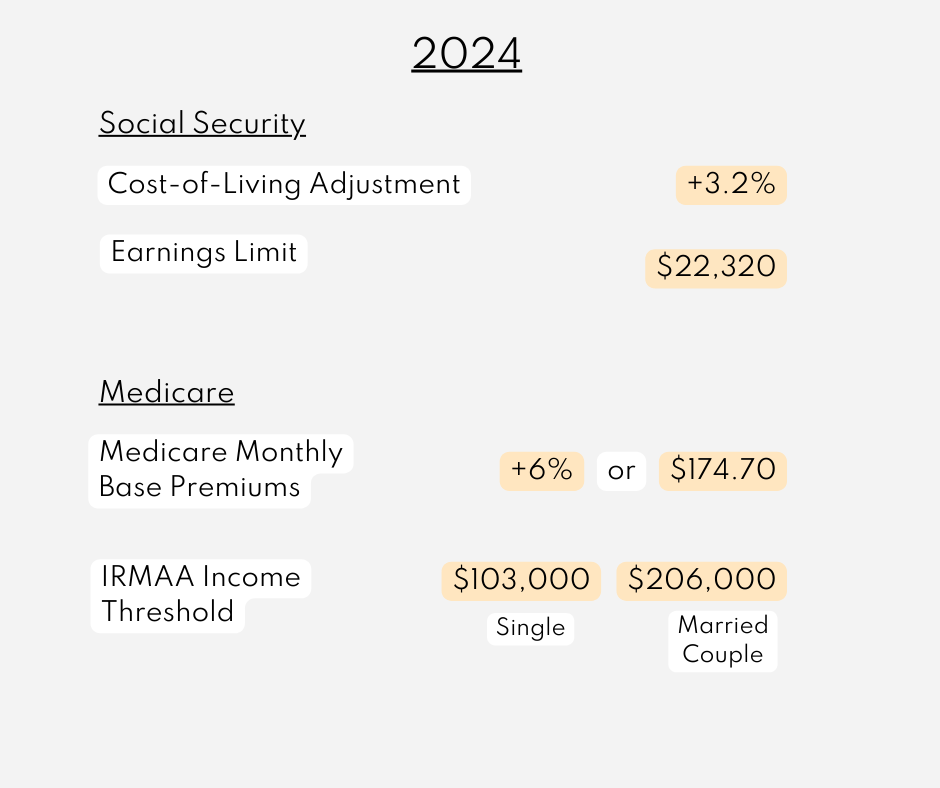

Social Security Cost-of-Living Adjustment and Earnings Limits

On October 12th the Social Security Administration announced that the cost-of-living adjustment for 2023 will be 3.2%. This year’s increase pales in comparison to last year’s 8.7% increase but is a signal that inflation has decreased significantly over the past year. The average monthly retiree benefit will increase by approximately $50.

The earnings subject to Social Security tax will rise from $160,200 to $168,200. In addition, the maximum an individual can earn annually while still collecting benefits prior to full retirement age will increase from $21,240 to $22,320. In addition, an individual can now earn up to $59,520 in the year they reach full retirement age.

Medicare Premiums

In 2023 we saw a 3% decrease in Medicare Part B premiums to $164.90. For 2024 Medicare enrollees will see close to a 6% increase in monthly base premiums to $174.70.

However, the hope is that less individuals will have to pay higher premiums known as IRMAA (Income Related Monthly Adjustment Amount) as the income threshold was adjusted upward for inflation by 6%. For a single taxpayer the first increase now begins at $103,000 vs. $97,000 in 2023 and for a married couple $206,000 vs. $194,000 in 2023.

Our team works hard to ensure that we are assisting our clients in appropriately planning around all areas of their financial lives. Whether it is determining what retirement vehicles to use and how much to save, when to elect Social Security benefits or planning around distributions during retirement to avoid unnecessary Medicare surcharges, we are here to help our clients plan according to their personal situations.

If you have questions and would like to discuss your personal tax or cash flow situation, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.