What You Need to Know About Financial Risk Protection

Written by: Marty Shields, CFP®, AIF®

When most people are considering financial risk management their first thought goes to mitigating downside risks with their investment portfolios. Although this can be an important part to a long-term financial plan, in most cases it is not as important as managing financial risks through having the proper insurance coverage. Insurance is one of the very few purchases you make that you hope you never have to use and truly don’t appreciate until something unfortunate happens to you and it is needed.

There are many areas of risk mitigation that can be handled using insurance including auto, home and health. I want to focus on the following three areas that need insurance protection and the best approach to handling it:

- Life Insurance

- Long-Term Disability

- General Liability/Umbrella Insurance

Life Insurance

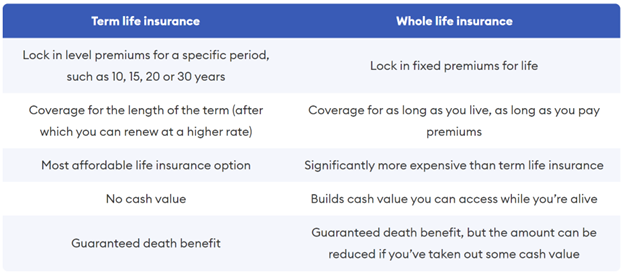

There are two main types of life insurance policies - term and whole/universal insurance. The proceeds from a life insurance policy are never taxed and will always transfer to the primary or contingent beneficiary of the policy.

Source: Forbes 2022

Term Life Insurance

Term life insurance is the simplest and least expensive type of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. This type of policy is the best fit for most people and should be used to cover liabilities such children’s college expenses, house mortgages, household debt and retirement if one or both spouses were to pass away. Once these liabilities have been paid off, most people do not need to have life insurance. This type of insurance does not build a cash value over time and if the policy is not utilized there is no value to redeem at the end of the term.

Whole Life/Universal

Whole or universal life insurance pays a death benefit whenever the policyholder dies but also builds a cash value that should increase over time. This type of insurance is usually designed to last for the full life of an individual and is significantly more expense than term life insurance. Because of their much higher premiums, these policies are best used for situations such as funding a life insurance trust that is used to lower estate taxes.

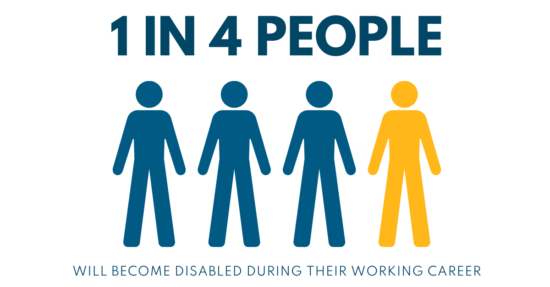

Long-Term Disability Insurance

Long-term disability insurance is defined as a policy that pays you, the policyholder, direct monthly benefits to replace a portion of your earnings if you become disabled and cannot work in your occupation. This is an important part of any risk mitigation plan as the odds of becoming disabled are much higher than the odds of dying.

Data from the U.S. Bureau of Labor Statistics

Below are the main components of a long-term disability policy.

The Benefit Amount

The benefit amount is usually between 60 – 80 percent of an individual’s annual income but there are caps on the total amount of coverage that can be provided. If the premiums are paid after-tax, then the benefit amount will not be taxed while if the premium amounts are paid pre-tax then the benefit amount will be taxed.

What is Covered

The policies are usually in one of the following categories - any occupation or own occupation. Any occupation policies will only pay out if you are not able to work any job because of your disability while own occupation policies pay out if you can’t work your current occupation. For all policies, there will be a list of exclusions that won’t be covered. They include items such as criminal activities and self-inflicted acts.

The Benefit Period

The benefit period can be for a set amount of time such as 10, 15 or 20 years or until a certain age like 65 or a combination of the two. There will be an elimination period that can vary from 90 days to 180 days that will need to be met before the policies start to payout.

General Liability/Umbrella Insurance

If you are sued for damages above your primary liability limits, an umbrella policy helps pay what you owe.

Umbrella insurance covers you and members of your household against lawsuits involving personal injury to others, damage to other people’s property, and a variety of claims such as defamation and landlord liability depending on your policy.

In addition to paying damages up to your liability limit, your umbrella insurance will typically also cover associated legal costs beyond that amount. For example, if you have an umbrella policy with $2 million of liability coverage, and you are sued for that full amount. Your insurer would pay out the $2 million plus provide your legal defense or cover your fees.

Umbrella insurance doesn’t cover your own injuries or property damage. For this type of coverage, you’ll need to rely on your health or auto insurance. This policy will not cover liability associated with your business unless you have a commercial umbrella policy rather than a personal one.

Most umbrella insurance policies won’t cover liability stemming from the breach of a contract. For example, if a contracting company sues you because you haven’t paid for the work it completed according to the contract, your umbrella insurance policy will not cover this expense. And if you hurt someone deliberately or commit a crime, you are not covered.

Boats are another common area of exclusion. Some companies cover certain sizes or types of boats. Others don’t cover them at all unless you have an existing boat insurance policy.

Having the proper coverage in these three areas is important to limit any risks that could impact the success of your financial plan. In most cases, the annual costs can be very reasonable and given the low premium costs and high potential risks, these are not great areas to try to self-insure.

If you have any questions regarding your insurance coverage in these areas, please contact our team at Bouchey to set up an initial meeting.