What Is T.I.N.A. and Why Is It Important to Me?

Written by: Paolo LaPietra, CFP®

Over the last few weeks, I’ve been discussing the relationship between the bond market and T.I.N.A with clients. Their initial facial expressions as they try to figure out who T.I.N.A is and what she has to do with the bond market are priceless. Before they start guessing, if it’s a grumpy relative I have to see during the holidays or the Queen of Rock ‘n’ Roll, Tina Turner, I explain that it’s an adage to describe the current investment market: There Is No Alternative.

This article will discuss the challenges in the bond market due to:

- Quantitative Easing

- Inflation

- Quantitative Tightening

Challenges in the Bond Market

Quantitative Easing

As I’m writing this blog, the S&P 500 index is up over 23% year to date while the Barclays Aggregate Bond is down 3%. To put it simply, the bond market is not an attractive place to be in currently and most likely won’t be for some time. Challenges in the bond market began in March 2020 when Federal Reserve Chairman (Fed) chair Jerome Powell implemented a monetary policy called quantitative easing (QE) and lowered the Federal Funds rate to zero to help kick start the recovery during the COVID recession. Quantitative Easing is when the Fed purchases billions of dollars of bonds to provide liquidity to the economy. These Fed actions make borrowing much more affordable for consumers and inject money into the economy to boost economic activity. This policy worked, as markets came roaring back in 2020 with the S&P 500 index ending the year up over 18% after being down around 35% in March. The problem here for bonds is that lowering the Federal funds rate lowers the yield for all current and future bonds being issued. This is the first reason why the forward outlook for bonds is unattractive. The second reason has to do with inflation.

Inflation

During a quantitative easing environment, when borrowing costs are low, consumers are more inclined to borrow and spend money. We saw this happen in the housing market this year. As mortgage rates were at a historic low, people were pushing their housing budget higher and higher, causing housing prices to surge. The housing market isn’t the only place we’re seeing inflation; it’s affecting everyday life as well: gas, food, and vehicles most notably. Inflation negatively affects bonds because bond yields are fixed, so if prices are rising and your bond yield remains the same, then you are realizing a negative return.

Quantitative Tightening

The third and final challenge facing the bond market is related to what Jerome Powell hinted the Fed will start doing in 2022—a policy called Quantitative Tightening (QT). QT involves the Fed starting to slowly raise the Federal funds rate, making borrowing more expensive, and tapering the amount of money they inject into the economy by not buying government bonds. This type of contractionary monetary policy helps cool off inflationary environments, such as the one that we’re currently in. QT has a negative effect on bond prices because this means new bonds being issued will yield more than bonds currently in circulation, dragging down the marketable price of current bonds.

Alternative Investments to Bonds

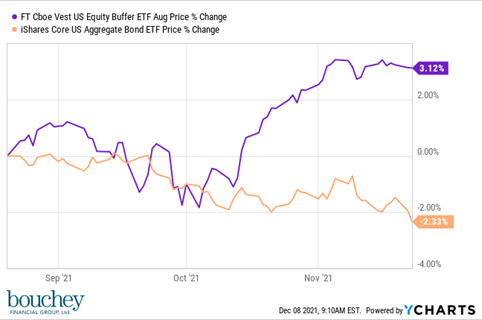

The investment committee here at Bouchey understood the headwinds facing bonds since the beginning of the year. With equities having great performance and a strong forward outlook while bonds are showing underperformance with a weak outlook, we discussed how There Is No Alternative (TINA) to equities right now in the market. The hurdle is how to add equities to a conservative allocation without creating too much volatility risk within a portfolio. One option is to use Defined Outcome ETFs. These investments use option contracts to provide direct exposure to the S&P 500, capping the amount you can make on the upside while buffering the amount you can lose on the downside. In Exhibit 1, you can see how our defined outcome fund performed versus the US Aggregate Bond Index.

Exhibit 1

With the defined outcome being up over 3% and bonds being down over 2%, our clients have made over 5% of what they would have made had they remained in a bond fund. These positions function well as an alternative to bonds because they give our clients the equity upside in their bond portfolio while limiting the amount of equity risk. As an investment committee, we will continue to explore investment alternatives such as defined outcomes ETFs during this fixed income bear market, but it’s important for all bond investors to step away from maximizing total yield and instead start thinking about maximizing total return.

If you have questions on how to protect your portfolio from these challenges to your bond allocation, please feel free to contact us to set up a meeting. Bouchey Financial Group is a fee-only, fiduciary, financial advisory firm with locations in Saratoga Springs & Troy, NY.

Related Article: Inflation: Why is this such a big deal and how does it affect me?