The Big Beautiful Breakdown: What’s In the New Tax Bill?

Written by: Vincenzo G. Testa, CPA, CFP®, ECA

On July 4th, 2025, the “One Big Beautiful Bill” was signed into law, bringing with it the biggest changes to the U.S. tax code in nearly a decade. While the news coverage has focused on the politics, our priority is helping you understand what this means for you - whether you're a high-earning professional, investor, business owner, or retiree.

This blog breaks down the key tax changes we think you should know about - some create new planning opportunities, while others may require adjustments to your current strategy. Our goal is to help you stay informed and make smart, proactive decisions moving forward.

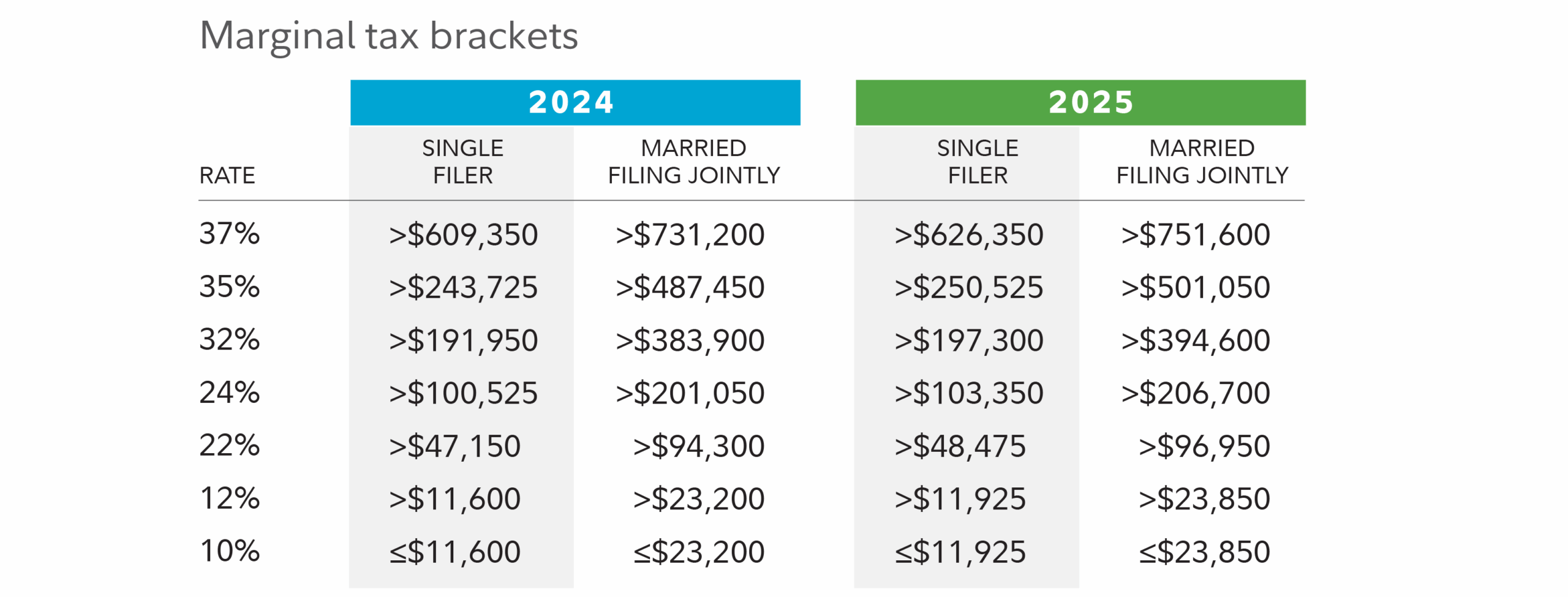

Lower Tax Rates Are Here to Stay

The 2017 Trump-era tax cuts for individuals have been made permanent. That means lower income tax brackets and a higher standard deduction will no longer expire after 2025.

Child Tax Credit Increased

The Child Tax Credit is now $2,200 per child (increased from $2,000), with income thresholds remaining the same. The credit is now partially refundable and indexed to inflation.

Expanded SALT Deduction (Temporarily)

The State and Local Tax (SALT) deduction cap has been raised to $40,000 starting in 2025, with a 1% yearly increase for households with a modified adjusted gross income (MAGI) under $500,000. Above $500,000, the SALT cap starts to phase out and drops to $10,000 once MAGI reaches $600,000.This expanded limit is temporary and revert back to $10,000 in 2030. The increase in the SALT Deduction will result in tax savings for many taxpayers.

New “Senior Deduction”

Taxpayers ages 65 and up can now claim an additional $6,000 deduction ($12,000 for married couples), which is aimed at reducing or eliminating tax on Social Security income. This deduction phases out for higher earners and expires after 2028.

Deductions Auto Loans (Temporarily)

Auto loan interest on U.S. made vehicles is deductible up to $10,000/year through 2028. This is an “above-the-line” deduction, which means that you do not have to itemize your deductions to claim this deduction. With auto loan rates at historic highs, this provision aims to increase demand on U.S. manufactured vehicles.

Estate & Gift Tax Exemption Increased

The estate, gift, and generation-skipping transfer tax exemption has been raised to $15 million per person ($30 million per couple), with inflation indexing going forward. This means – an estate will only owe Federal estate tax if the worth of the estate is above those thresholds. State Estate Tax Laws may differ.

New Investment Account for Dependents (“Trump Accounts”)

Trump Accounts” are tax-advantaged savings accounts seeded with $1,000 at birth for every U.S. child born from Dec 2025 to Dec 2028. Families can contribute up to $5,000 annually, with tax-deferred growth and favorable tax treatment on withdrawals used for education, first-time home purchases, or small business investments. Funds must be invested in low-cost U.S. equity index funds, and early or non-qualified withdrawals are penalized.

Charitable Deduction Rules for Non-Itemizers

The new legislation brings back an above-the-line charitable deduction and this time, it’s permanent. Starting in 2026, taxpayers taking the standard deduction can write off up to $1,000 (single) or $2,000 (joint) in cash donations to qualified charities. This allows non-itemizers to reduce their AGI and receive a tax benefit for giving without having to itemize their deductions.

As always, the right strategies depend on your individual goals, income, and long-term financial picture. If you have questions about how these changes impact your tax planning or investment strategy, we are here to help you navigate the changes with clarity and confidence. For other items included in the bill not listed in this blog, please reach out to an advisor to discuss in greater detail.