Understanding the Ins and Outs of Medicare: A Financial Advisor’s Guide

Written by: Scott Strohecker, CFP®, EA

As you approach retirement, or if you are already in that phase, navigating the complexities of Medicare can feel overwhelming. The decisions you make regarding your healthcare coverage can have significant implications for your financial well-being. It is essential to be fully informed about Medicare so that you can make the best decisions for your health and finances.

What Is Medicare?

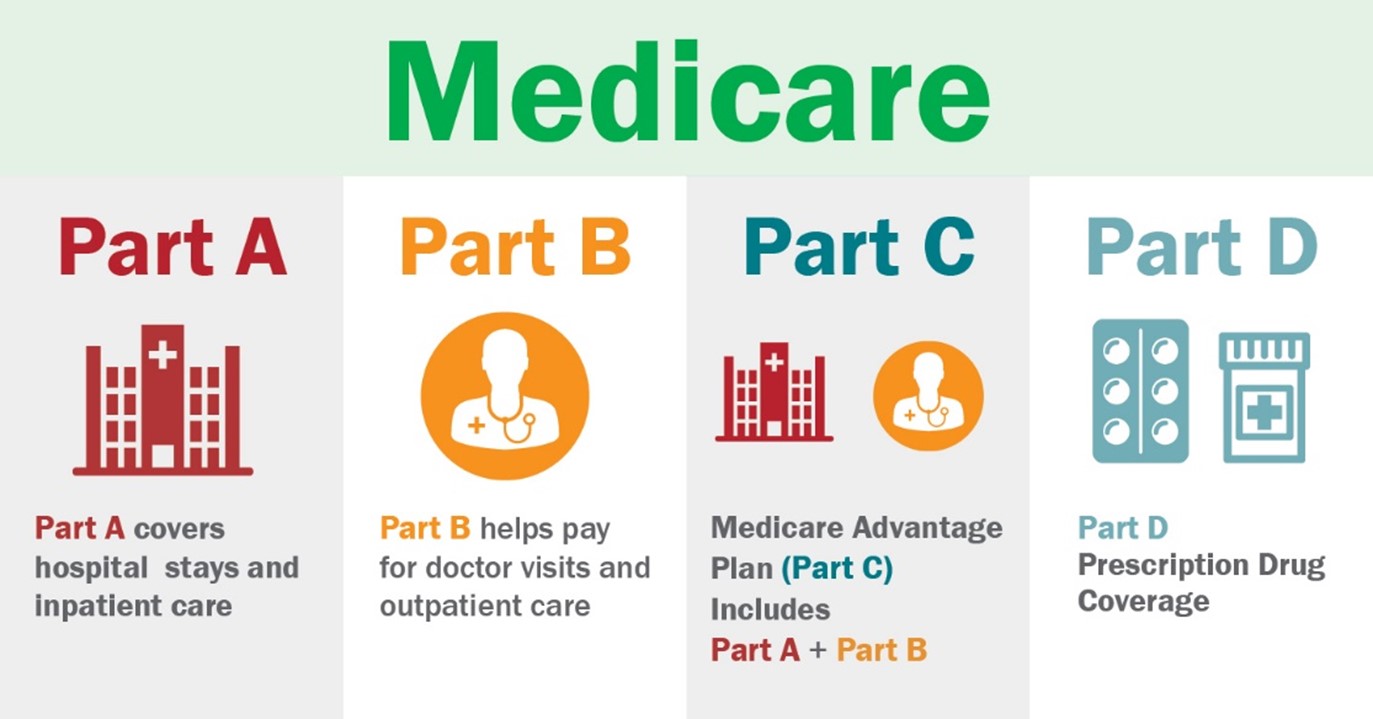

Medicare is a federal health insurance program primarily for people aged 65 and older, though it also covers some younger individuals with disabilities or specific conditions. It is divided into different parts, each offering different types of coverage.

The Four Parts of Medicare

1. Medicare Part A (Hospital Insurance): Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people do not pay a premium for Part A because they or their spouse paid Medicare taxes while working.

2. Medicare Part B (Medical Insurance): Part B covers outpatient care, preventive services, doctor visits, and other medically necessary services. Unlike Part A, there is a monthly premium for Part B, which is adjusted based on your income in retirement.

3. Medicare Part C (Medicare Advantage): Medicare Advantage plans are an alternative to Original Medicare (Part A and Part B) provided by private insurance companies. These plans often include additional benefits like vision, dental, and prescription drug coverage. However, you will still need to pay the Part B premium.

4. Medicare Part D (Prescription Drug Coverage): Part D provides coverage for prescription medications. This is an optional benefit, but if you do not enroll when you are first eligible and you do not have other creditable drug coverage, you may face a late enrollment penalty.

When Should You Enroll?

Your initial enrollment period (IEP) for Medicare begins three months before the month you turn 65 and ends three months after your birthday month—a total of seven months. If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B. However, if you are not receiving benefits, you will need to sign up yourself. If you are still working, you can delay enrollment and avoid late enrollment penalties if your employer has more than 20 employees.

What About Supplemental Insurance?

Medigap is supplemental insurance sold by private companies to help cover out-of-pocket costs not covered by Original Medicare. Medicare does not cover everything, like copayments, coinsurance, and deductibles. You can purchase a Medigap policy during your six-month Medigap Open Enrollment Period, which begins the month you turn 65 and are enrolled in Part B.

Medicare and Your Financial Plan

Medicare should be an integral part of your overall financial plan, especially considering the rising costs of healthcare. Here is how to integrate it:

Budgeting for Healthcare Costs: Estimate your healthcare costs in retirement, including premiums, out-of-pocket expenses, and potential long-term care needs. This will help ensure your retirement savings are sufficient.

Reviewing Income Levels: Since Part B and Part D premiums are income-based, review your adjusted gross income (AGI) to determine if it is beneficial to adjust your income in retirement to lower these costs.

Long-Term Care Planning: Medicare does not cover long-term care, so it is crucial to plan for this potential expense. Investigate options such as long-term care insurance or self-insuring through your retirement savings.

Common Pitfalls to Avoid

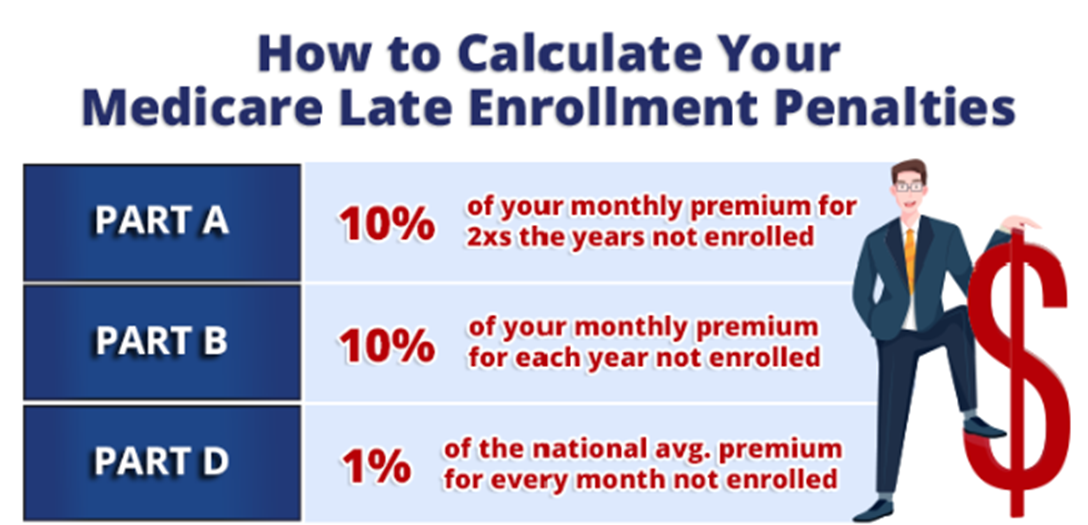

Late Enrollment Penalties: Missing your initial enrollment period for Parts B and D can result in lifetime penalties. It is essential to enroll on time unless you have other credible coverage. Further information about late enrollment penalties can be found online at Medicare.gov or using this link.

Overlooking Medigap Enrollment: Failing to purchase Medigap during your open enrollment period may lead to higher premiums or denial of coverage due to pre-existing conditions.

Ignoring Annual Plan Reviews: Your health needs and the plans available can change from year to year. It is vital to review your Medicare plan annually during the open enrollment period to ensure it still meets your needs.

Final Thoughts

Navigating Medicare is a crucial aspect of your retirement planning. By understanding the different parts of Medicare and how they fit into your overall financial plan, you can make informed decisions that protect your health and financial security.

The team at Bouchey Financial Group is here to help you learn more about Medicare and how it can impact your financial plan. Remember, your health and financial well-being go hand in hand, and we are committed to ensuring you are prepared for whatever lies ahead. If you have questions on Medicare, please contact our office to speak with one of our trusted advisors.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.