Social Security Planning: Understanding and Planning Around Benefit Reductions

Written By: Catherine (Katie) Buck

We will cover:

- What is social security?

- Social Security Planning

- Benefit Reductions

Social Security

The Social Security Bill was signed into law on August 14th, 1935 by Franklin D. Roosevelt. The benefits for retired workers were designed to prevent dependency and entitle retirees to some form of income during retirement, with the smallest benefit amount being $10 and maximum of $85 in 1935.

In order to qualify for your full benefit, you must be fully insured or have 40 quarters of work earning at least $1,730 (2024). The highest 35 years of earnings are used to calculate a person’s Average Indexed Monthly Earning (AIME). From there the AIME is used to compute your PIA or primary insurance amount and then, finally, your monthly benefit amount is derived.

Social Security Planning

If you have researched your Social Security Benefits using www.ssa.gov you will see a chart showing your potential monthly benefits depending on the age at which you elect your benefit. You can elect to take your benefit beginning age 62 or you can delay electing your social security benefit. Every year you delay will increase your benefit by 8% until you reach age 70. At age 70, you’ve maximized your benefit, and it will not continue to grow. So, when should you be taking your social security benefit?

The question is not so black and white, and the answer will be different for everyone. Your retirement age, retirement savings, other retirement income, expected lifestyle, employment income and family health history should be factored into this decision-making process when you consult with your financial professional.

Benefit Reductions

Full retirement age is important to keep in mind during social security planning and varies depending on your year of birth. It is more common now to have a Full Retirement Age (FRA) around age 67 for those born after 1960 but can begin at age 65 for those born in 1937 and beyond. You can determine your FRA using resources from the Social Security Administration.

Why is Full Retirement Age important? This is the year in which you can receive your full retirement benefit in relation to your age. Electing your benefit prior to Full Retirement Age will permanently reduce your benefit up to a maximum of 30% and can be temporarily reduced depending on your income prior to Full Retirement Age.

Specifically, if you elect your social security prior to your Full Retirement Age your benefit will be reduced by 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month afterwards.

Example: If your FRA is 67 and that benefit amount is $1,000 a month. You decide to elect social security at age 62, your monthly benefit would be $700 or a 30% permanent reduction.

36 months x (5/9) x 1% = 20%

24 months x (5/12) x 1% = 10%

Total Reduction: 30%

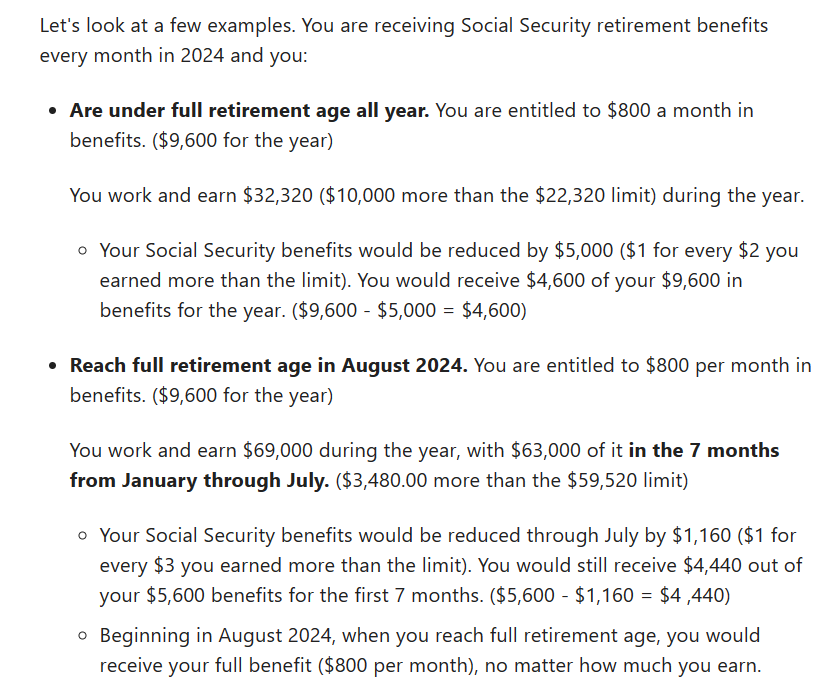

If you elect your social security prior to your Full Retirement Age and you have employment income over a certain limit (indexed annually) the social security administration will temporarily add another reduction to your already reduced benefits until you reach your Full Retirement Age. Thankfully, if this reduction is applied, you will be credited back those dollars once you reach Full Retirement Age. The additional and temporary reduction to your benefit will be $1 for every $2 you earn over $22,320 (2024), prior to Full Retirement Age.

In the year of your Full Retirement Age, for example, if your 67th birthday is in July, you have 6 months in which a different income threshold limit is applied to your benefit. In 2024, this limit is $59,520 and the reduction will change to $1 in benefits for every $3 over this new limit. This income threshold is applied only during the months of the year prior to your birth month in which you will reach Full Retirement Age. In my example, you must have earned income under $59,520 from January to June (6 months) to avoid this $1 for $3 reduction. Once you reach your birthday month, you are free to earn as much income as you’d like without this temporary reduction. And your social security benefit will be recalculated to give you credit for the months it was reduced or withheld due to your excess earnings. To further illustrate this concept, see the example below from www.ssa.gov.

Conclusion

Navigating social security is challenging and can often lead to confusion and frustration. Ensuring you understand the potential risks of taking your social security benefit early is essential in retirement planning but unfortunately can be overlooked. Generally, we recommend that people should choose to delay as long as possible if it makes sense for their situation. Collecting your benefit early can have a reduction in your benefit up to 30% including an additional reduction over an income limit of $22,320 (2024).

Take the time to consult with your financial advisor and have a proper social security analysis based on your specific situation. If you have any questions regarding social security or any retirement planning, please reach out to our office.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.