How Does the Social Security Fairness Act Impact Me?

How Does the Social Security Fairness Act Impact Me?

Written by: Samantha Masey, CFP®

The Social Security Fairness Act was signed into law on January 5, 2025, as an effort to increase social security benefits for certain types of workers that were affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). According to the Social Security Administration, “These provisions reduced or eliminated the Social Security benefits of over 2.8 million people who receive a pension based on work that was not covered by Social Security (a “non-covered pension”) because they did not pay Social Security taxes.”

These workers include:

- Teachers, firefighters, and police officers in many states

- Federal employees covered by the Civil Service Retirement System

- Individuals whose work had been covered by a foreign social security system

The benefit increase amount varies based on variables such as pension amount and type of social security benefit received. Some may receive an increase of over $1,000 per month.

To determine if this affected you, individuals can follow these steps:

- Review your employment history

- Log in to SSA.gov to review your benefit estimate or contact the Social Security Administration

- Consult your financial advisor

If you are eligible and already collecting social security, the monthly benefit automatically increased as of February 24, 2025. In addition, you would have received a one-time payment for retroactive benefits beginning January 2024.

If you have never applied for social security benefits due to WEP and GPO, simply apply at ssa.gov or schedule an appointment.

Does it impact all workers?

Although the Social Security Fairness Act will help many workers, the majority of state and local employees work in social security covered employment and pay social security taxes which in turn means they are already eligible for social security benefits. These individuals would not be affected.

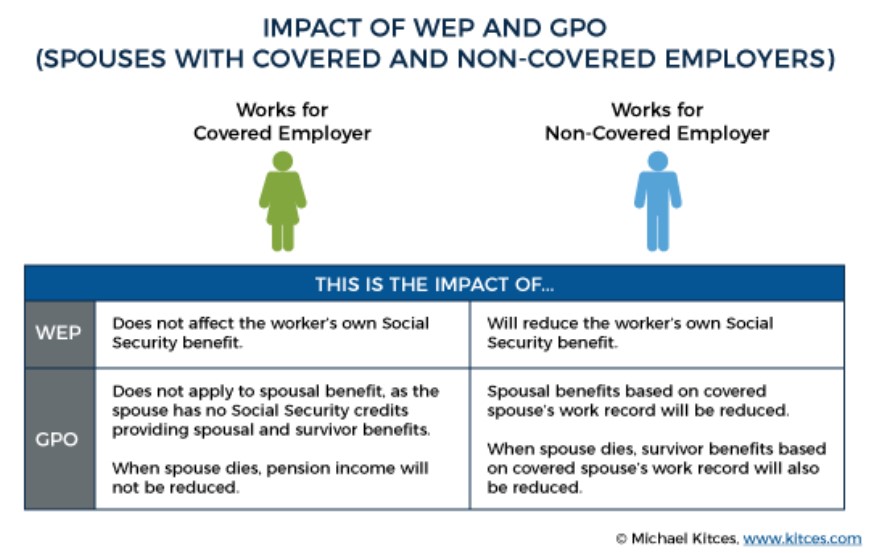

The illustration below reviews the impact of WEP and GPO before they were repealed by the Social Security Fairness Act on January 5, 2025. In summary, if an individual worked for a non-covered employer (jobs that do not pay into social security) it would reduce their own social security benefit and spousal/survivor benefit they qualified for. These are the individuals that are impacted.

In conclusion, the Social Security Fairness Act provides meaningful change for individuals who are eligible. Moving forward, their social security benefits will no longer be reduced due to a government (non-covered) pension and if they qualify for spousal or survivor benefits, they will be paid in full.

If you would like to discuss whether this affects you with a financial advisor, please contact us at 518-720-3333.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.