Understanding and Maximizing Your Financial Aid Through FAFSA

Written by: Paolo LaPietra, CFP®

Navigating the process of financial aid and scholarships is a major step for students aiming to manage and minimize the burden of student loan debt. The process, although complex, unlocks numerous opportunities for making higher education more accessible and affordable. This blog provides a comprehensive guide that dives into the essentials of financial aid, highlights the critical role of the Free Application for Federal Student Aid (FAFSA), and offers strategic advice to optimize your financial aid package.

We will review:

- The Basics of Financial Aid

- Key Tips for Maximizing Financial Aid

- Navigating Scholarships

- Other Strategic Considerations

The Basics of Financial Aid

Financial aid in the United States is designed to support students in covering educational expenses, including tuition, room and board, and other educational expenses. The main types of financial aid include:

- Grants and Scholarships: These funds do not require repayment and can come from federal, state, educational institutions, or private sources. They are awarded based on various criteria including financial need, academic merit, or specific talents.

- Loans: Federal student loans typically offer lower interest rates and more flexible repayment options than private loans. They must be repaid with interest but can be a crucial resource for filling funding gaps. The main federal student loans include:

-

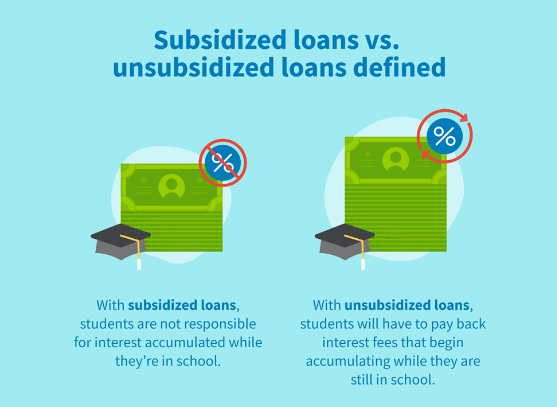

- Direct Subsidized Loans: For eligible undergrad students who demonstrate financial need to help cover the costs of higher education at college or career school.

- Direct Unsubsidized Loans: Available to undergrad, grad, and professional students; eligibility is not based on financial need.

- Direct PLUS Loans: Available to grad or professional students and parents of dependent undergrad students to help pay for education expenses not covered by other financial aid.

- Work-Study Programs: These programs provide part-time jobs that help students earn money while in school to help pay for their expenses.

- CSS Profile: Administered by the College Board, the CSS profile is a more in-depth financial review that is required by some private colleges and universities to determine your eligibility for non-government financial aid.

Understanding each type of aid is crucial as they each come with their own set of rules and eligibility requirements.

Why FAFSA Matters

The FAFSA is the single most important form for securing financial aid in the U.S. It provides access to the largest pool of financial aid options including federal grants, work-study opportunities, and loans. Take some time to read Federal Student Aid’s (FSA) blog to learn more about the upcoming 2024-2025 FAFSA form here.

- Access to Federal Aid: Approximately 47% of all grants and scholarships are distributed through programs accessed via the FAFSA.

- Eligibility Assessment: FAFSA determines your Student Aid Index (SAI), which colleges use to decide how much financial aid you are eligible to receive.

- State and Institutional Aid: Many states and colleges use FAFSA data to award their own financial aid, so failing to complete the FAFSA can mean missing out on these opportunities as well.

Key Tips for Maximizing Financial Aid

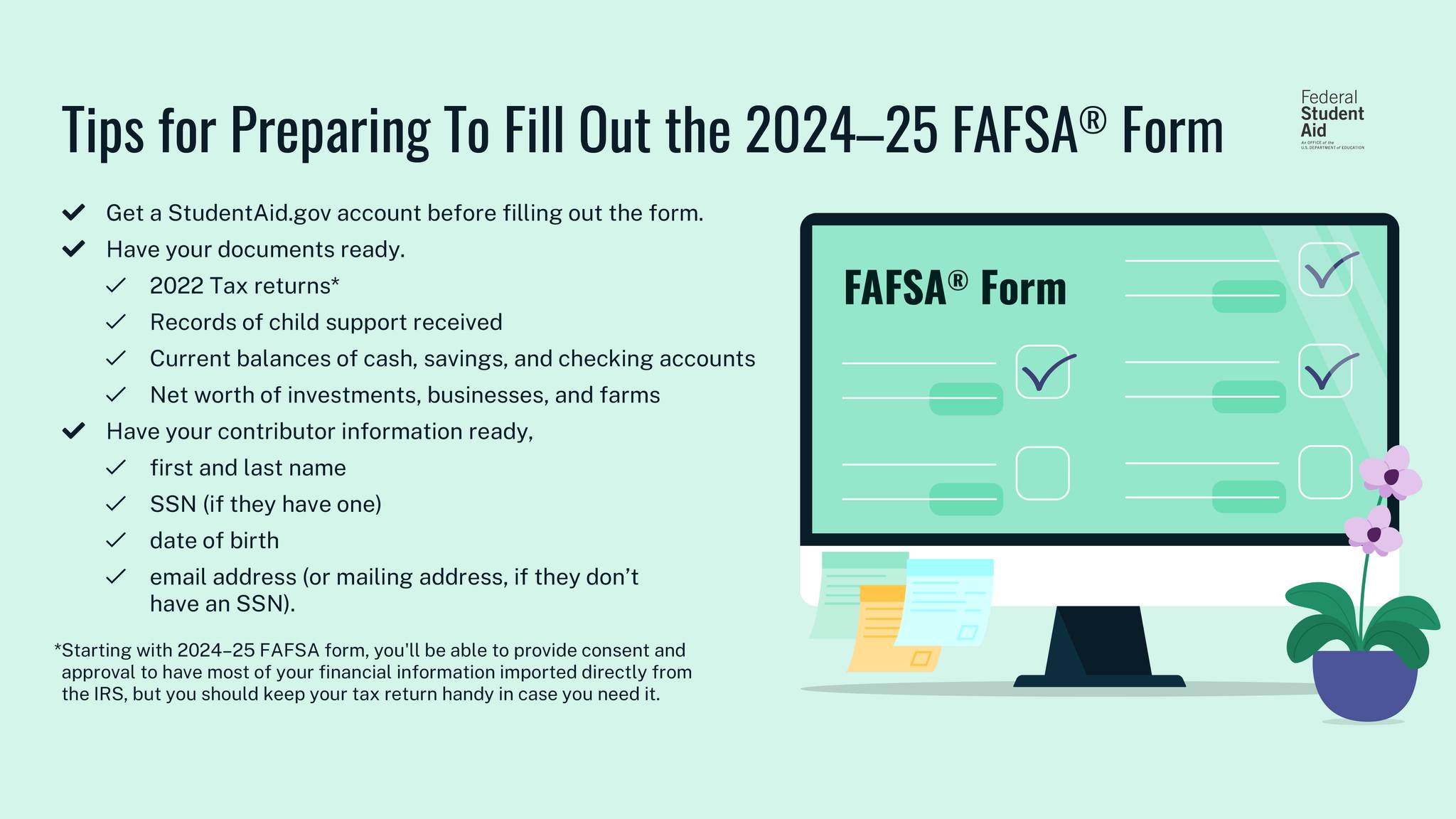

- Prepare Early: Gather all required documentation including your Social Security number, tax returns, bank statements, and any investment records before starting your FAFSA application to avoid delays and errors.

- Submit Early: FAFSA applications are accepted starting on October 1st each year. Early submission is advised because some aid programs operate on a first-come, first-served basis.

- Review and Revise Your FAFSA Annually: Financial situations can change, so it’s important to update and resubmit your FAFSA each year to reflect your current financial status.

Navigating Scholarships

While FAFSA is key for federal aid, scholarships can significantly reduce your education costs without the burden of repayment. Here are some tips to effectively search and apply for scholarships:

- Broaden Your Horizons: Look beyond national scholarships to include regional, corporate, and college-specific opportunities. Use online tools like Fastweb.com, Scholarships.com, and the College Board’s Scholarship Search.

- Be Thorough: Apply for scholarships where you meet all eligibility criteria and pay close attention to the application instructions. Tailor each application to highlight how you meet the specific scholarship criteria.

- Stay Organized: Keep track of deadlines and required materials. Consider using a spreadsheet to manage application timelines and requirements.

Strategic Considerations

- Understand the Full Scope of Offers: When you receive financial aid offers from colleges, compare them carefully. Don’t just look at the total amount of aid, but also at how much is grants versus loans, and understand the conditions attached to each offer.

- Consider Long-term Implications: Be cautious of over-borrowing. A common rule of thumb is not to take out more in loans than you expect to earn in your first year after graduation.

- Seek Help When Needed: Don't hesitate to contact financial aid offices for advice or to clarify anything about your aid package or FAFSA application. They can provide valuable insights and assistance.

By following these guidelines and tips, students and parents can effectively navigate the financial aid process, optimize their aid packages, and take proactive steps towards funding their education responsibly. The process through college financing doesn’t have to be intimidating, and with the right knowledge and resources, students can secure the financial support they need to achieve their academic and career goals.

Remember, the key to managing college costs is not just about securing the money; it's also about smart planning and ongoing management of your finances before, during, and after your college years. Always aim to minimize debt and maximize grants and scholarships where possible.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.