Tax-Savvy Investing: Navigating the Backdoor Roth for Maximum Returns

Written by: Samantha Masey, CFP®

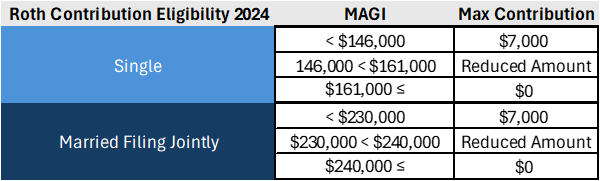

Are you a high earner that is no longer eligible to make Roth IRA contributions? It may be time to consider implementing a backdoor Roth strategy. When it comes to saving for retirement, most individuals are aware of the basic vehicles available to them such as their employer plan, IRAs, and Roth IRAs. However, once an individual reaches an income level that exceeds the Modified Adjusted Gross Income limit for Roth IRAs, they are no longer eligible to make contributions. This blog will discuss what a backdoor Roth is and when it makes sense to implement it.

Learn about:

- How to do a Backdoor Roth

- Who is the ideal candidate?

- What are the benefits?

- What are the risks?

Although 2023 has ended, there is still time to do a backdoor Roth for 2023. Taxpayers have until the tax filing deadline on April 15th to take advantage of this strategy.

How to do a Backdoor Roth

The process of a backdoor Roth involves the following steps:

- Make a nondeductible contribution to your traditional IRA

- Convert the funds to your Roth IRA

- Invest the money and receive the long-term benefits of tax free growth

Since there are no income limits on traditional IRA contributions or conversions, this strategy enables high-income individuals to indirectly contribute to a Roth IRA.

Who is the ideal candidate?

The ideal candidate is a high earner who does not already have traditional IRA savings and won’t need the Roth IRA funds for at least five years. This person will be most effective in using the backdoor Roth strategy without sacrificing funds to the pro rata rule or penalties.

Benefits of a Backdoor Roth:

- Tax-Free Growth: Just like regular Roth IRA contributions, these funds will grow tax-free, allowing for potentially significant gains over time. Your goal should be to maximize your Roth IRA contributions while you have a long-time horizon to let the funds grow.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have required minimum distributions which means an individual can leave the money to grow in their account if they like. This can be advantageous for those who wish to preserve their retirement savings for as long as possible or plan to leave the funds to a beneficiary.

- Legacy Planning: A Roth IRA is an excellent way to transfer wealth to the next generation in a tax efficient manner. In general, the beneficiary of a Roth IRA will be subject to the 10-year rule which means they need to fully deplete the account within 10 years. However, these withdrawals will be tax free to the beneficiary which can be a huge benefit if that person is already in a high tax bracket.

- Tax Diversification: Incorporating a backdoor Roth IRA into your retirement portfolio provides tax diversification, allowing you to manage your tax liability more effectively by having a mix of taxable and tax-free income sources. This can be particularly useful when trying to avoid a higher income tax bracket or avoiding higher Medicare premiums in retirement.

Potential Risks

While a backdoor Roth strategy offers numerous advantages, it's important to be aware of the potential risks.

- Pro-Rata Rule: The IRS considers all your traditional IRA assets when calculating the tax implications of a Roth conversion. Therefore, if you have both pre-tax and after-tax dollars in a traditional IRA when you do a backdoor Roth, the conversion will be a proportional share of both types and impact the tax efficiency of the conversion. For example, let’s say your traditional IRA already has a balance of $4,000 when you make a non-deductible contribution of $6,000 for your backdoor Roth IRA. When you do the conversion, the IRS doesn’t let you take use the after-tax $6,000. Instead, your conversion will be 40% pre-tax and 60% after-tax, just like your overall weighting in the IRA. You will then pay ordinary income taxes on the pre-tax amount in the year the conversion occurs.

- Withdrawal Penalties: It is important to know the timeframe in which you will need to access the funds as you do not want to incur an unnecessary penalty. Withdrawals before age 59 ½ will be subject to a 10% penalty and conversions are subject to the Five-Year Rule. This rule states if you withdraw converted amounts before the end of the five-year period starting January 1 of the tax year you made the conversion, the earnings portion of the withdrawal may be subject to income taxes and a 10% early withdrawal penalty. Careful tax planning is needed to avoid these tax liabilities.

- Future Legislative Changes: As we know, tax laws can evolve. As such, future legislative changes might impact the viability or benefits of the backdoor Roth strategy. Staying informed about tax regulations is key to adapting your financial strategy accordingly.

If done correctly, a backdoor Roth is a powerful financial strategy and should be a nontaxable event. If your situation fits the ideal criteria for using this strategy, there is still time to do one for the 2023 tax year and of course, for 2024. The maximum contribution amounts are:

- $6,500 for 2023, $7,500 for those age 50 or over

- $7,000 for 2024, $8,000 for those age 50 or over

If a backdoor Roth strategy is something you would like to have a discussion with an advisor about, please feel free to contact our team.