Behavioral Finance: The Psychology of Money

Written By: Catherine (Katie) Buck

How we feel about money has been ingrained in us from an early age. Our cognitive biases influence how we feel about investing and will drive our financial decisions. Understanding and identifying these biases is an important part of financial advising that allows professionals to navigate around them to help maximize clients’ financial success. This blog will discuss four prevalent cognitive biases in behavioral finance and offer strategies to counteract their influences.

Today we will discuss:

- Anchoring

- Confirmation Bias

- Loss Aversion

- Herd Mentality

Anchoring

Anchoring is when individuals rely on the first piece of information they receive on a specific subject or topic when making decisions. This can skew the perception of value or potential risks. For example, if you see the price of a stock to be $100/share and it drops down to $80/share, you will believe this to be a bargain. However, you haven’t conducted enough research to determine if this stock is over or undervalued, even at the price drop of $80/share. To avoid the risks of anchoring it is recommended to conduct research through multiple, reliable sources of information to ensure the information you receive is accurate.

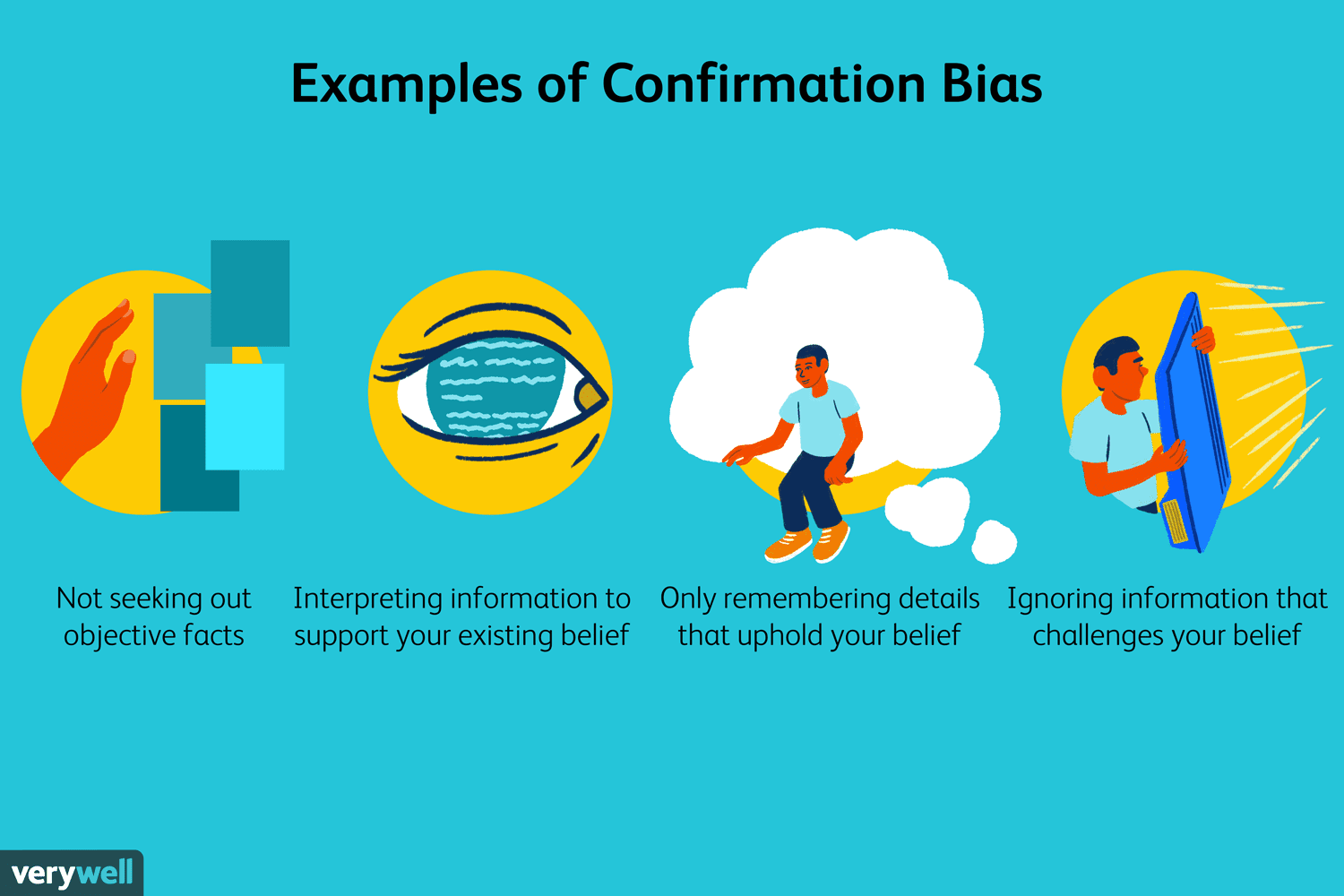

Confirmation Bias

Confirmation Bias refers to the tendency to seek out information that confirms your beliefs on a specific subject and ignoring contradictory information. For example, an investor could believe company XYZ, owned by their favorite celebrity, will continue to perform well throughout the year and decide to invest additional funds into XYZ stock. However, the investor had thrown away a newspaper article highlighting the favorite celebrity’s irresponsible behavior such as accusations of money laundering. Confirmation bias can be avoided by thorough and open-minded research that engages a diverse scope on the subject in question.

Loss Aversion

Loss aversion is when someone actively avoids losses instead of attempting to achieve gains. In other words, being afraid of failing and therefore never attempting to try. This can be seen through an investor holding onto a losing stock longer than necessary hoping to recoup the losses. Your financial professional can provide clarity around loss aversion through focusing on long-term goals, diversification, and reassessing risk tolerance periodically. This will help mitigate the fear of losses and promote a rational investment strategy.

Herd Mentality

Lastly, herd mentality is how it sounds, following the herd and making decisions based on what others are doing. For example, during the dotcom bubble, many dotcom companies did not have stable business models, but many investors bought-in because everyone else was buying into them as well. The best way to combat herd mentality is through thorough research and consulting with your financial advisor to ensure it aligns with your long-terms goals and portfolio strategy.

Conclusion

Understanding the psychology of money is essential for overcoming behavioral biases and making more informed financial decisions. By recognizing common cognitive biases such as anchoring, confirmation bias, loss aversion, and herd mentality individuals can develop strategies to mitigate their impact and achieve greater financial resilience. By staying vigilant, seeking diverse perspectives, and adhering to sound investment principles, investors can navigate the complexities of the financial markets with greater confidence and clarity. If you have questions and would like to discuss your situation, please reach out to the team at Bouchey Financial Group.

Related Blogs: Sink or Swim - How the Sunk Cost Fallacy Could Be Affecting Your Investment Decisions

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.