Utilizing Technology in Investing: The Power of Direct Indexing

Written by: Paolo LaPietra, CFP®

Technology has continued to enhance the relationship between investors and the markets. Going back to the early 1990s, one of the most significant milestones was the introduction of Exchange-Traded Funds (ETFs). ETFs allowed access to lower-cost diversification and tax efficiency compared to mutual funds and are now one of the most popular investment vehicles for investors. As investors continue to explore ways to leverage technology, an innovative approach that is gaining significant traction is direct indexing. Direct indexing offers a personalized and customizable way to build and manage a portfolio, bringing a multitude of benefits to investors. In this blog post, I’ll dive into the capabilities of direct indexing and explore its numerous advantages.

This article will discuss:

- Understanding Direct Indexing

- Personalized Portfolios & Diversification

- Tax Efficiency

Understanding Direct Indexing

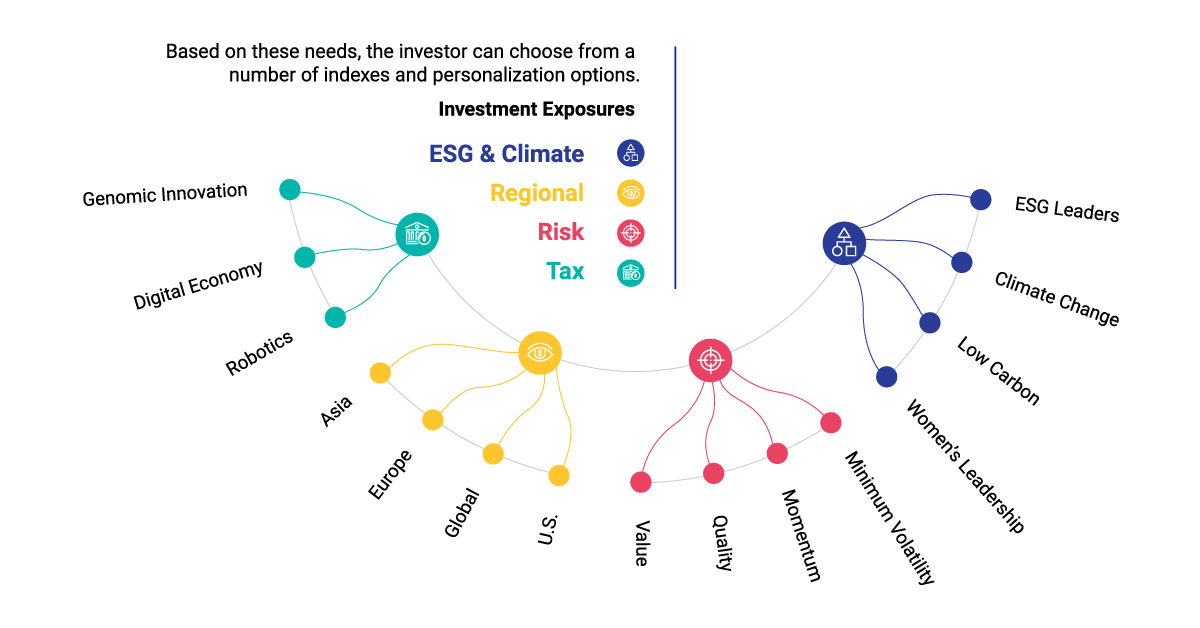

Direct Indexing is a strategy that allows investors to own individual stocks directly, eliminating the need for traditional investment funds like ETFs or mutual funds. Instead of purchasing shares of an ETF or mutual fund, investors build a portfolio of individual stocks. These portfolios can track a multitude of different indexes or benchmarks. Many direct indexing platforms allow you to blend different indexes or benchmarks together, essentially enabling you to build your own customized index.

Personalized Portfolios & Diversification

One of the most compelling benefits of direct indexing is the vast level of personalization it offers. Investors can tailor their portfolio to specific preferences and financial goals. This means specific industries or companies can be included or excluded in the index based on an investor’s values and preferences. For example, if an investor is passionate about green energy, they can choose to exclude fossil fuel-related stocks from their portfolio, making sure their investments align with their values. Direct indexing can also deliver diversification when an investor has a concentrated position. When an investor holds 20% or more of their portfolio in one company, the portfolio is vulnerable to single-stock events. Putting a concentrated position into a direct Indexed portfolio can allow an investor to build around this position by underweighting the sector in which that position resides. For example, if an investor has a large position in Apple, the investor can restrict exposure to Apple or the technology sector altogether. After stocks are built around the concentrated position, this creates a tax efficient way to start trimming the position over time.

Tax Efficiency

Tax efficiency is arguably the main attribute that drives investors towards direct indexing. When investors own individual stocks, they have more control over the timing of capital gains and losses. This allows for strategic tax-loss harvesting, where underperforming stocks are sold to offset gains, potentially reducing the tax liability. Going back to the example of a concentrated position, utilizing the losses from underperforming stocks can offset the gains from the concentrated position, bringing diversification to the portfolio over time. Aside from a concentrated position, direct indexing can provide exposure to any area in the markets while actively tax-loss harvesting throughout the year. This provides a strategic opportunity to enhance their after-tax returns.

Conclusion

Direct indexing represents another milestone in how technology provides tools to investors. Since Steve Bouchey started Bouchey Financial Group over 30 years ago, he has made it a priority to leverage technology to ensure our clients maximize their overall financial wellness. Whether direct indexing is used for its extensive personalization, tax efficiency, or diversification, we are excited to implement this strategic tool for our clients. As with any investment decision, it’s important to have a plan in place. If you are interested in learning more about direct indexing, please schedule a meeting with our team.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.