Understanding Debt

Written by: Catherine (Katie) Buck

Debt is an integral part of many people’s lives. In fact, it is a part of our culture to incur debt to buy a home, build a business, or finance education. We intend to use debt as a tool to better our lives and achieve our financial goals. However, it is a double-edged sword that can lead to financial hardship and strain if not managed properly. This article will provide a holistic perspective on debt by diving into basic debt characteristics; reviewing good and bad debt; and providing debt management tips. Whether you have control over your debt or need to regain control of your finances, understanding debt can empower you towards financial well-being.

In this article we will discuss:

- Basic Debt Characteristics

- Good Debt

- Bad Debt

- Understanding Your Debt

- Debt Management Tips

Basic Debt Characteristics

Debt is a financial obligation where one party borrows money from another with an agreement to repay the borrowed amount at the cost of interest. The original sum of money borrowed is called the principal amount. The price for borrowing the principal amount is known as interest. Lenders will charge interest on the principal amount, and it is based on factors like credit-scores, loan type, and market conditions. Interest rates can be fixed, meaning the interest rate does not change during the term of the loan or they can be variable and may change over time due to the benchmark rate known as the “prime rate”. The prime rate will fluctuate based on market and economic conditions. The time frame agreed upon to repay the principal at the stated interest rate is the Term. Mortgages typically have a term of 30-years, while car loans are traditionally between 2-5 years.

Debt has many forms: bonds, mortgages, credit card balances, lines-of-credit. These forms have varied arrangements and characteristics for debt repayment. When you decide to purchase a new car and fund it with a loan from the bank, you are using a form of secured debt. Meaning your debt has a form of collateral attached. If you were to default on this loan, the bank would repossess and sell your car to recoup the money lent. There is also unsecured debt which is not asset-backed. An example of this is credit card debt. If you were to default on unsecured debt, you can be taken to court to repay the amount owed. This can be a costly event with legal fees alone. From the lender’s perspective, secured debt is less risky than an unsecured debt, and therefore will typically have a lower interest rate. Debt can also be categorized as a revolving or installment debt. As it sounds, revolving debt is available for reuse after paying down the original debt, like a Home Equity Line of Credit (HELOC). Some people will use their HELOC for multiple home improvement projects over the years. With good credit history, a credit line’s available debt balance can increase over time. Installment debts are “one-and-done” lump sum loans that are repaid over a set schedule with a fixed amount until the balance is completely paid off.

What is Good Debt

Debt is not wholly good or bad. Although some may categorize debts in this black-and-white fashion, every “Good Debt” has the potential of having a very negative impact on a person’s financial situation. Good debts help you build your wealth or generate income, like obtaining a mortgage to purchase a home. Utilizing debt to invest in yourself or an appreciating asset can be beneficial as investing in assets or opportunities that may not have been afforded otherwise through debt, with the hopes of higher returns, is an advantageous tool. However, it is important to consider and understand there are potential risks when utilizing debt in this fashion. The primary risk is defaulting, or failing to meet your debt obligation, like a mortgage payment. This can negatively impact your credit and may lead to bankruptcy. This can potentially happen if you were to lose your job or were to unfortunately lose a spouse contributing to your household finances. Therefore, it is important to keep in mind that while “Good Debt” can lead to better financial position, overleveraging that debt and unforeseen events can lead to financial hardship.

What is Bad Debt

The term “Bad Debt” can be intimidating and overwhelming, especially for those who struggle with debt, but it can still play a beneficial role in everyone’s financial situation. The debts are usually connected to the purchase of a depreciating asset. A great example of this is credit card debt. If you are racking up a credit card balance on clothes, toys, or other depreciating items and not paying off the balance, you will incur high interest charges. In the high-interest rate environment of 2023, the average credit card interest rate is 20.68%. A good way to combat high fees is to avoid purchasing unnecessary items and setting up automatic monthly payments on your account.

If you manage your bad debts properly, they can be advantageous in a few ways. Using a credit card can provide additional financial security. Credit cards have well managed fraud departments and can easily be frozen in case of misplacement. For additional information on the perks of credit cards, read our blog on this topic here. Proper management of bad debt has its own advantages amidst its formidable drawbacks.

Understanding your Debt

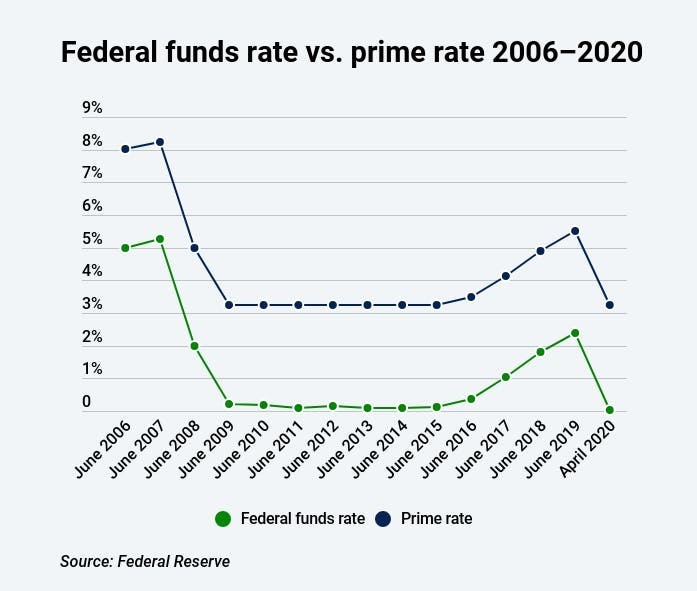

Understanding your debts is the first step towards organizing a payment plan. Most importantly, determining your debts’ interest rate. Remember, a fixed interest rate does not change over the life of the loan. A variable interest rate will change over the life of the loan depending on an underlying benchmark interest rate known as the “prime rate” which moves in-synch with federal funds rate. The federal funds rate is determined by the Federal Reserve, and it is a tool used in monetary policy to either stimulate or cool down the economy. The prime rate is higher than the federal funds rate and is the interest rate commercial banks charge their customers with excellent credit ratings. Simply put, it serves as the reference point for various loan types. The image below will provide an illustration of the relationship between the federal funds rate and the prime rate from 2006 to 2020.

Debt Management Tips

Setting clear goals for debt repayment is the first step to living a debt-free life. A rule of thumb is to pay off high-interest rate debts, 5% or above, over your lower interest rate debts. Create a detailed list of all your debts including their balances, interest rates, and minimum monthly payments to give you a clear picture of your financial situation. Next, create a realistic monthly budget and determine your nondiscretionary costs. This can help you identify where extra money can be saved and put towards your high-interest rate debts. Setting up automatic payments on your debts can lower interest rates and avoid late fees. However, this depends on the policy of the institution you are borrowing from. Make sure to avoid any new forms of debt like signing up for another store credit card. Lastly, enjoy those payment milestones as you make your way towards financial freedom!

Making sure you understand debt and its rewards and repercussions can help you responsibly manage payments and work towards financial freedom. If you need advice on how to manage your debts or how to utilize debt to increase your wealth, contact us to begin the conversation.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.