Q3 2023 Market Update

Is Good News Bad News Again?

Written by: Ryan Bouchey, Chief Investment Officer

Market Summary

It’s hard to believe that we’re already entering the 4th quarter of 2023. As I started writing my overview last week, I felt this may be a welcome sign as we rid ourselves of the volatility from this past quarter. But as the week has progressed, we’ve seen a bit more volatility to start the 4th quarter as bond yields accelerated, furthering a stock and bond market selloff to start the week.

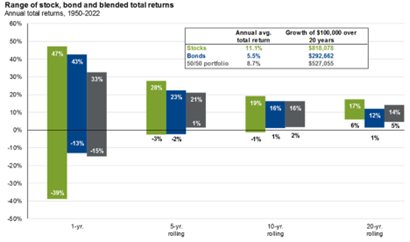

What started out as a great run-up in markets through the first half of the year has turned into volatility and a pullback from the cycle highs at the end of July. But alas, not all hope is lost. We still see reasons for optimism (today’s HUGE jobs report!) and if you’ve been invested in the market long enough, we know favorable market results come with “costs” – ie; volatility. It always brings me back to one of our favorite charts showing how volatile stocks can be on a short-term basis, but that volatility smooths out over time and becomes much less risky.

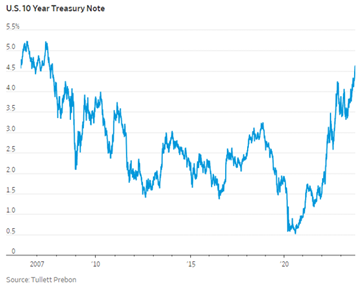

The good news is that it’s still beneficial to be invested in the stock market. It’s getting even better if you’ve been a more conservative investor or saver and are taking advantage of the highest rates, we’ve seen in the past 15-plus years – both of which we’ve been taking advantage of this year. As we continue to update you with our bi-weekly newsletters, the theme of late has been this “holding pattern” if you will in the markets where we are getting some good news, some bad news, but overall, we tend to stick in the goldilocks middle. From a market’s standpoint, this should be a positive as the Fed tries to navigate the proverbial soft-landing. However, this past week of rapidly rising rates does make the case for a soft-landing being a bit tougher as higher rates could be a catalyst for further market volatility.

U.S. Equities

U.S. equities just had their worst quarter of the year, especially when compared to the strength of the first half of 2023. While a pullback like this can be frustrating, it’s important to remember that it’s both very common and still well off an average pullback we see in any typical year. While the last two months’ drawdown has been more drawn out, the 3rd quarter ended down 6.6% from the recent July highs, it isn’t much different than what we experienced back in March. As we’ve shared in the past, the average intra-year drawdown tends to be closer to 15%, so this latest pullback shouldn’t deter our long-term plans.

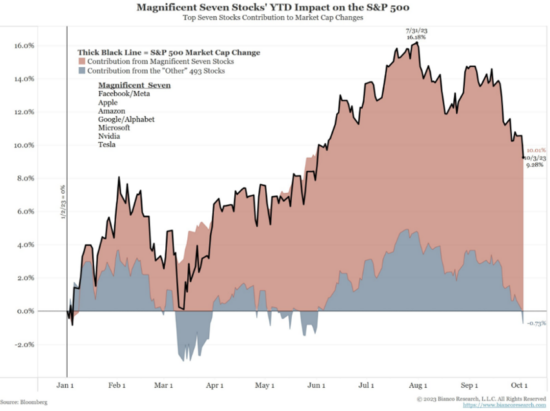

What I’m sure is on most investors’ minds at this point is are we seeing a standard pullback or is it a sign of worse times to come. After the leadup from earlier in the year of the “Magnificent 7” – Apple, Microsoft, Google, Amazon, Nvidia, Tesla and Facebook, there was more market participation as we entered the 3rd quarter which was a sign of positive momentum to keep the bull market moving forward. The bad news it seems for the market of late is the continued strength of the overall economy, stickier inflation and a higher-for-longer rate environment that is resulting from this strength. It’s almost as if we’re back in good news is bad news for the markets on a day-to-day and headline basis. As of writing this today, if you took away the “Magnificent 7”, the overall market is back to being down for the year.

The market desperately wants a lower rate environment, as high rates tend to be a hurdle for stocks, especially growthier stocks. And given the rapidly rising rates from this past week, we’re seeing heightened market volatility as a result. When you can park money risk-free at over 5% yield, there needs to be a more convincing growth story to get investors excited about stocks. We saw it for a while with some of the AI advancement earlier in the year, and while that should be a long-term catalyst, the near-term excitement has faded a bit. Earnings season over the next month will be critical as to what’s next for stocks as they need strong earnings growth to justify higher valuations.

Fixed Income & Interest Rates

Following a 35-year bull market for bonds, there has been a significant uptick in rate volatility since 2020. Although this has been a short-term challenge, with us shifting most of our fixed income allocation to alternatives 18-24 months ago, there are concerns with how volatile rates have been recently, especially this week. This year we’ve started to take advantage of the higher interest rate environment, while also being patient as the market continues to digest data and there are signs of more positive momentum for even higher rates from here.

Our view since the beginning of the year is that we were in for a higher interest rate environment, with the tight labor market being the main driver of our thesis keeping elements of inflation stickier than the Fed wants. And even with the uncertainty earlier this year within the banking sector, this patience has paid off. We’ve been adding to our fixed income allocation as the year progresses, while also keeping some ultra short-duration within the portfolio, benefiting from the higher “short-end of the curve” while systematically adding to longer duration to lock in rates. Just like it’s impossible to time market tops and bottoms for the stocks, the same can be said for interest rates so much of what we are doing is from a risk management perspective and it’s paying off.

The Fed has stated their intention to get inflation under control, and although we are a long way from 9% inflation we saw last summer, we’re still hovering around 2% higher than the Fed’s stated target of 2%. Most of the trends are in the right direction, however labor and housing (and this quarter energy) have remained too high. Until we see a real trend of weakness in the labor markets, following Augusts’ job report is not happening, we think this trend continues to the end of the year. This is a big reason why positive economic news had led to the stock market selling off. But if you’re a saver, higher rates will benefit you for much longer than we thought possible as rates are at 17-year highs. It’s important to control what we can control and make the most out of our current environment.

Economy & Closing Thoughts

Just as we thought we were seeing some positive momentum heading into the last week of the quarter, our elected officials in Washington created some volatility to close out September with the fear of a government shutdown looming. Unfortunately, this led to a 4th straight week of market declines to close out the third quarter. I’m glad they were able to come to a resolution over the weekend, however we still have another deadline kicked down the road coming our way in mid-November and the uncertainty of a new Republican House Speaker as negotiations heat up doesn’t help matters.

We continue to see some mixed signals in the economy, with the overall trend remaining strong. Although it hasn’t been a huge positive for stocks in the short-term, long-term this should benefit us as investors as a stable economy and a strong consumer leads to better opportunities of hitting earnings growth potential. As I heard the term recently from Bloomberg’s Joe Weisenthal, these trends fall in line with the “golden path” to the Fed’s soft landing.

As much as been made about decrease in savings rate and higher debt for the consumer, what’s been lost in some of the data is that overall balance sheets are on the rise, thanks to rising housing prices. And although deposits to banks is coming down, a big reason for this is that we now have alternatives for cash! Why park your money at a bank earnings less than one percent when you can park that money in money market funds, CD’s or short-term treasuries all yielding above 5%! There will always be headline grabs trying to show how bad things are, but it’s important to take a step back and digest all the data at our disposal. Some trends can be viewed as a negative, but overall, we continue to see enough strength to move this bull market forward.

Our view of the market remains cautiously optimistic, but this latest bought of volatility with rates does have feeling a bit cautious in the short-term. Unless earnings surprise on the upside, which we could see, we may be in for some more short-term volatility. Because of this, you may see some trades to rebalance the portfolio that better aligns us with this current environment.

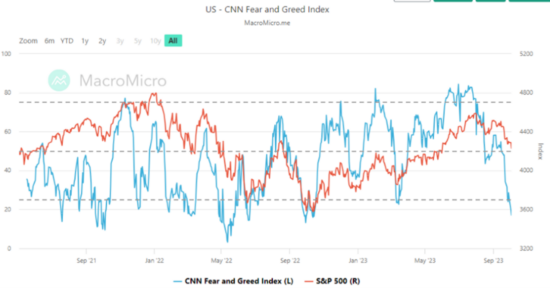

If the recent volatility gives you any hesitation of being invested in the markets, please reach out to one of our advisors to dust off your financial plan. We continually stress test plans to account for volatility, and as I said earlier, market volatility is the inherent cost of long-term market success. As the chart below shows, as fear increases (blue line heading down) market success tends to accelerate (red line)! It’s not uncommon for markets to recover at the exact time most folks feel hope is lost.