Q2 2023 Market Update

Mid-Year Check-In and Outlook

Written by: Ryan Bouchey, Chief Investment Officer

Market Summary

We’re at the halfway mark for 2023 and the fear and concern many investors had at the end of 2022 feels like it was six years ago, not six months. We’ve seen a dynamic shift in both markets and market sentiment, and the headlines that drove many folks into hiding in the early stages of the year have also dramatically shifted. It’s not like there haven’t been legitimate reasons for concern but the market has pushed aside many of these obstacles and hasn’t looked back.

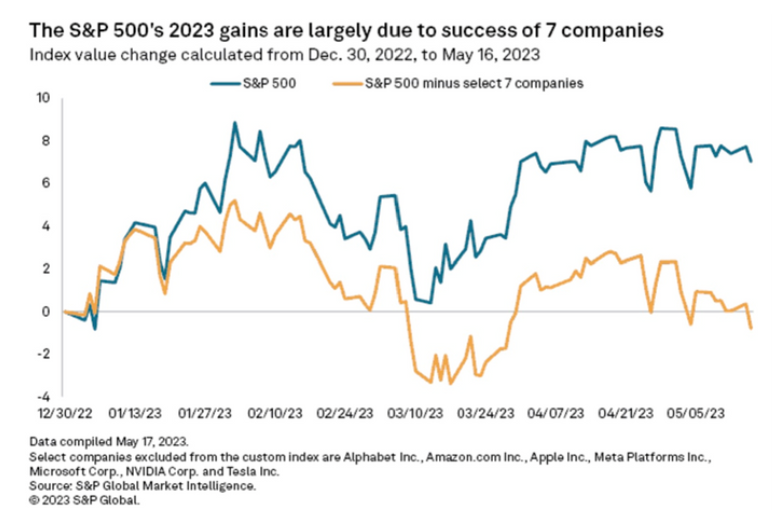

Will this strength continue into the latter half of the year? I know enough never to make any predictions like that. However, using history as our guide, the recent broad participation and strength within the markets to start the year is a good sign for continued strength moving forward. We’ve seen the biggest companies in the market drive this rally, and while their continued growth will be needed to keep it going, I would be surprised if that divergence and outperformance from the mega-cap growth companies continues at the pace we’ve seen to start the year.

Will this strength continue into the latter half of the year? I know enough never to make any predictions like that. However, using history as our guide, the recent broad participation and strength within the markets to start the year is a good sign for continued strength moving forward. We’ve seen the biggest companies in the market drive this rally, and while their continued growth will be needed to keep it going, I would be surprised if that divergence and outperformance from the mega-cap growth companies continues at the pace we’ve seen to start the year.

U.S. Equities

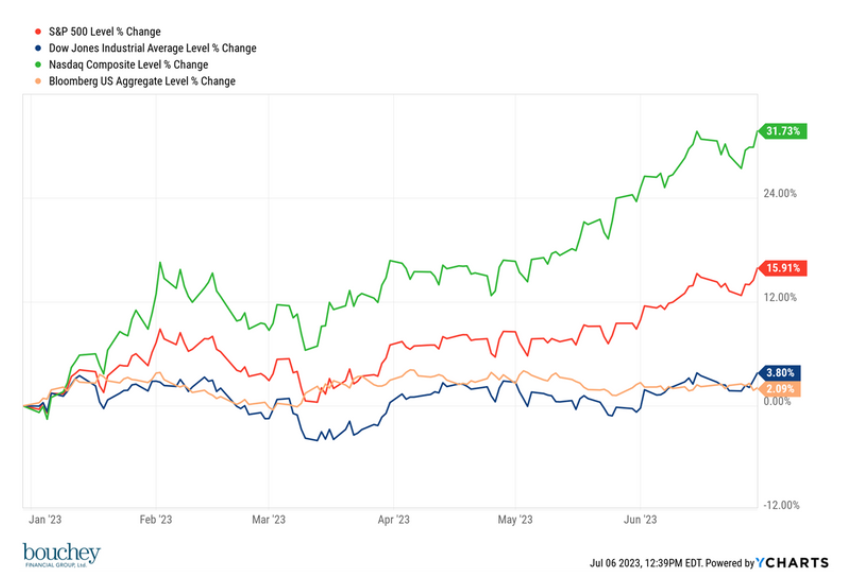

Many investors were ready to give up on equities at the start of the year, and maybe it was a good thing that they were also ready to give up on bonds leaving very few places to go with their money. Investors who were patient, especially in the areas of the stock market most beaten up in 2022, have certainly been rewarded to start the year. As good as the first quarter was for the S&P 500, which was up 7%, the momentum continued for the 2nd quarter as it added another 8.3% for a YTD total return of 15.9%. Not to be outdone, the NASDAQ is up 31.7% for the first half of the year, the best return in 40 years.

Given how most of the headlines this year were all about the inevitable recession, what can we attribute this year’s strength in stocks to? For one, the market is always forward looking. I continue to believe that last year’s selloff had more to do with pricing in a slowing economy versus the headlines being all about inflation and the Fed. We also try to drive home with our clients that the market isn’t going to wait for positive headlines to begin its recovery. If you were to wait for positive headlines, most of the gains will pass you by. This doesn’t mean taking on undue risk, but it does drive home the importance of “time in the market, not timing the market.” We continue to believe this is the best long-term approach to any portfolio.

What do stocks do from here? We wrote about it a few weeks ago, but it is interesting to see how most of this year’s gains in the S&P 500 can be attributed to the 7 largest stocks in the market. This is a very narrow window for the market to be trading in, and as you can see from the below chart, without those seven companies leading the way, the market would have been down through mid-May. While this could be viewed as concerning, the good news is the rest of the market has begun to catch up. June saw all 11 sectors at a gain, leading to an increase in market confidence and market expansion, which is key for future growth.

With the large divergence between mega cap tech companies and the rest of the market, will the trend continue? It’s tough to bet against momentum, so we continue to like large-cap growth in the portfolio. However, the extreme outperformance we’ve seen so far this year is unlikely to continue for the long-term, at least from a historical perspective. We favor diversification as other areas of the market are in a position to play catch-up. It wouldn’t be a surprise if we saw some volatility along the way, as there’s always the potential for further negative headlines or market volatility. But the strength of the first half of the year and the breadth of this recovery is a good sign for continued growth now and into the future.

Fixed Income & Interest Rates

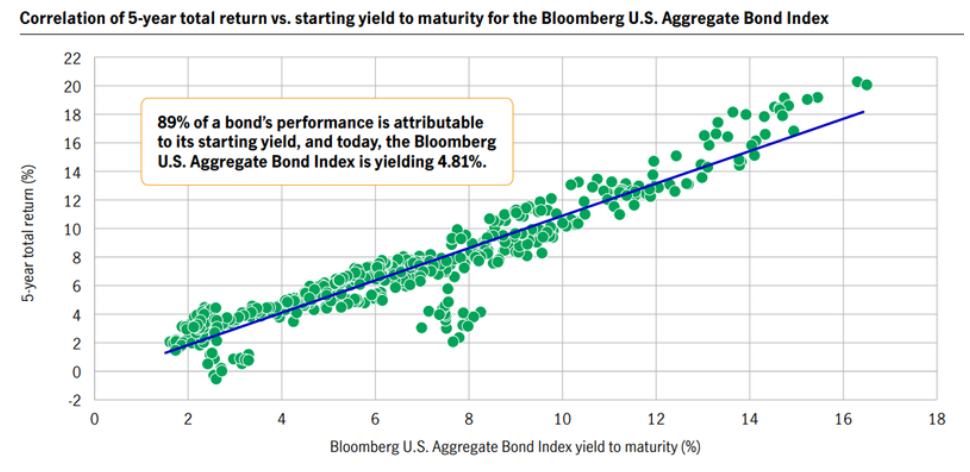

Not only did the equity market surprise many investors in the first half, but the bond market has been on a rollercoaster of a ride since the start of the year. As bad as last year was for bond investors, this year has certainly been more rewarding, with the overall bond market back at a gain. We’ve seen price appreciation and starting yields in the short to intermediate markets have been very encouraging. As you can see from the chart below, the starting yield of your bond investment (whether it’s through an individual bond or an ETF!) is a strong indicator of the long-term rate of return for a given bond. Just like with equities, we need to have a long-term mentality when it comes to our bond holdings. I love the chart below that highlights how important the starting yield is when you invest in bonds.

Interest rates have been on a rollercoaster of a ride, the biggest impact coming from the Silicon Valley Bank collapse back in March. Our view was that rates would be higher for longer given the strength of the economy, however the SVB disruption brought rates down faster than any period since Black Monday back in 1987. At the time, we fortunately did not overreact and stuck to our conviction. The market brushed aside the fear, and rates have slowly crept back up since March. We’ve been overweight ultra short-term treasuries given that we are getting over 5% on some of these holdings. We recently started pushing some of our bond holdings out further (1-3 years), and you may continue to see us capture more yield in the 5-10 year range in the coming days or weeks as rates have rebounded to their near highs we haven’t seen in over a decade.

Economy & Closing Thoughts

The economy continues to hum along, although we did just see our first jobs report miss last week. It wasn’t much lower than expected, however the average this year has been about 275,000 jobs / month and June only created 209,000. This is a trend worth following since the labor market will be the key indicator of a slowing overall economy and has the biggest potential impact on interest rates moving forward. The strong labor market has been a big reason why we felt we would see rates higher for longer. And although the hiring pace slowed a bit, the fact that wages are rising at 4.4% in June puts more pressure on the Fed potentially raising rates again at the end of the month.

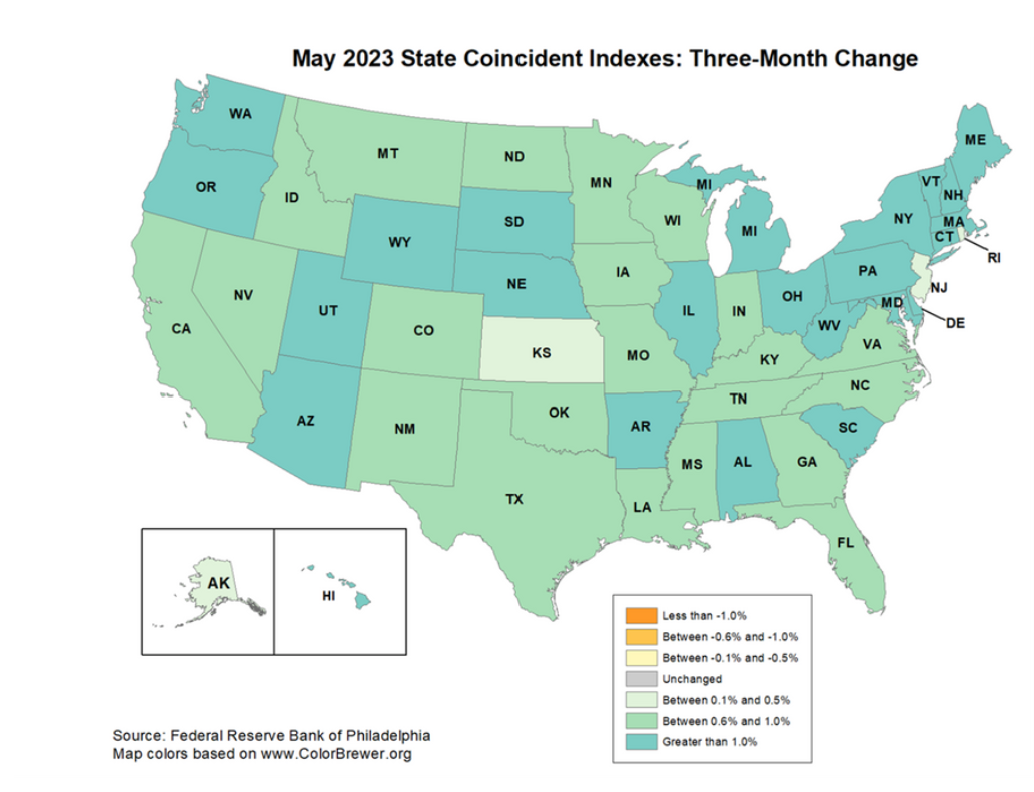

First quarter GDP was recently revised upward to 2% and spending from the consumer has shifted but continues its strength. We’re seeing less spending on goods and more on services like healthcare and travel. The Philadelphia Fed produces a heat map of economic changes state by state, and so far this year it all looks positive. There are no signs of an obvious economic recession which should be a positive for stocks. Our feeling is stocks will continue down a path based more on fundamentals versus concerns over interest rates. The Fed & inflation may drive short-term volatility, but for the market to continue its strength earnings will be critical now and into the latter half of the year. We’ll be focusing on that moving forward and feel comfortable with our allocation to quality companies that should do well in this environment. With valuations and earnings multiples expanding past their long-term averages, increased earnings will be a key factor in how stocks close out 2023.