Q1 2023 Market Update

Market Resiliency & The Path(s) Forward

Written by: Ryan Bouchey, Chief Investment Officer

Market Summary

Given the challenges the market faced in 2022 and continues to face in 2023, the first quarter was quite the start to the year. The word that comes to mind to describe the first three months of the year is resiliency. Resiliency, as the market has continued to face the challenges of inflation, higher interest rates, slow down in earnings, and most recently with Silicon Valley Bank (SVB). This first quarter was a great example of a resilient market in the face of many headwinds and uncertainties.

It was also a good reminder that the market is not always the economy, and vice versa. We continued to say the markets would bottom out when we least expected them, mainly because the market is always forward-looking. It’s so difficult to time markets because as efficient as markets are, they don’t always line up with the headlines (both positive and negative) we see in the news. If you wait for positive news or headlines in a bear market to get invested, odds are you’re too late.

Now this isn’t to say we’re in the clear just yet. We still face many headwinds and uncertainties. But as we’ve been saying since the end of 2022 and during our State of the Economy presentation – we are cautiously optimistic in this market environment. There will be times of volatility, along with the typical negative headlines. But if you’re a long-term investor with the proper time-horizon and allocation, we feel now is a good time to be invested.

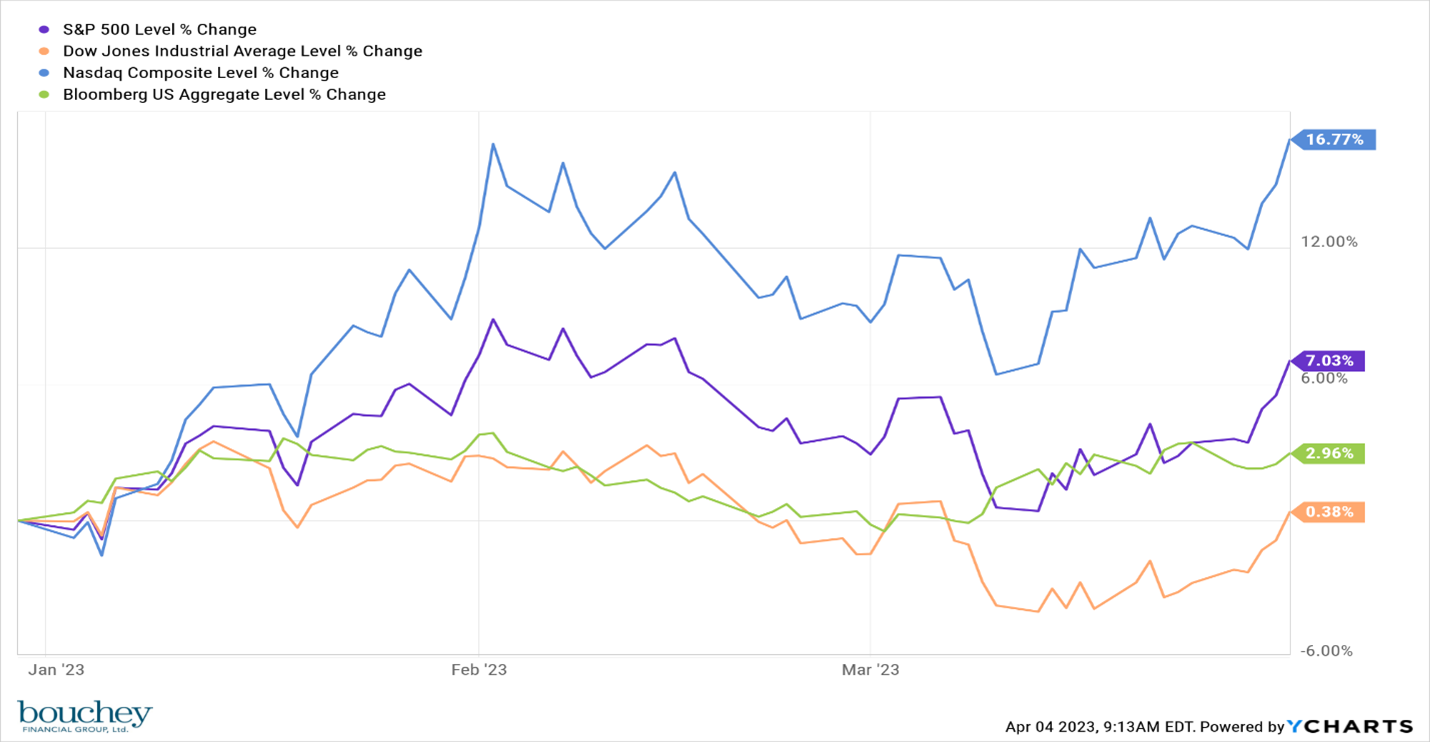

U.S. Equities

The start of the year saw the markets rally, led by growth & technology stocks. The leadership from these companies wasn’t a surprise given the steep losses they faced in 2022 (reversion to the mean), the velocity and speed to the rebound is quite surprising, and most likely not sustainable throughout the year. In fact, just about the entirety of the S&P 500’s 7% growth to start the year can be attributed to seven companies (according to DataTrek analysis) – Apple, Microsoft, Nvidia, Google, Facebook, Amazon and Tesla. Remove these seven companies, and the S&P would be slightly down for the year.

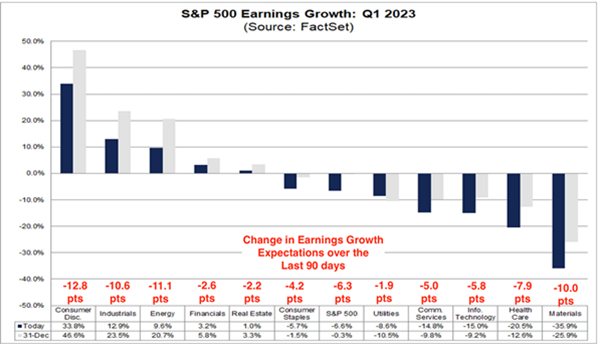

The biggest headwind to U.S. equities now comes in the form of earnings. Going back to the end of 2022, we felt earnings and profitability would come to the forefront for the market at some point in 2023. When you cut through the noise of headlines only talking about interest rates and inflation, the real story is that quality companies would come through during a difficult economic time and challenges faced by corporations during this earnings cycle. As you can see below, every sector in the S&P 500 has had their earnings expectations downgraded since the start of the year:

Not only have earnings been downgraded, but only three sectors have earnings expectations above the current inflation level. This is an effect of interest rates being as high as they are, and the impact it has on the overall economy. When the market was down in 2022, the reason given was inflation and the Fed. With the markets rising in 2023 the earnings story has gone a bit under the radar. We are still heavily focused on it, which is why the changes we made to the portfolio focused on companies showing balance sheet strength and earnings / profitability power. With the potential impact of a tighter credit market given the struggles with Silicon Valley Bank and the banking sector, we continue to feel good about these strategic moves, especially when you consider the above chart.

Interest Rates & The Fed

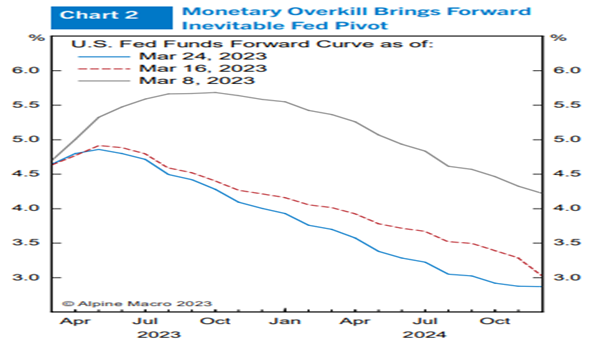

As the old saying goes, “Don’t Fight The Fed,” and it could not be more true than what we’ve seen over the past 3-4 weeks. If I told you the 16th largest bank in the U.S. would collapse in the matter of 3 days, with the potential to lead to a tightening credit cycle, would you have guessed markets would be up 4-weeks later? Again, this is why timing the stock market is so hard. But what it also tells us is the market optimism is being driven by the change in interest rate expectations & the Fed’s approach moving forward. Look below at how dramatically expectations have shifted since the SVB collapse.

March 8th was when news first broke of Silicon Valley Bank, and in the weeks since the expectations on the direction of the Fed Funds Rate (which is the overnight rate set by the Federal Reserve, currently at 4.75%-5%) has significantly changed. You can see from the chart above, expectations moved quickly lower in what the Fed would do moving forward – expectations originally were for a Fed “pivot,” or when they would lower rates, for the 4th quarter of 2023.

That all changed the week of SVB’s collapse when expectations shifted to a Fed pivot by some time in the 2nd quarter of 2023. The market liked this as it signified easing of rates, which long-term could help the economy get over any current obstacles.

As for the fixed income market, the Silicon Valley Bank collapse had a huge impact here as well. We hadn’t seen the 2-year Treasury yield move as quickly as it had since Black Monday of 1987. While rates moving down as fast as they did help the market value of bond and bond funds alike, it did make entering into the fixed income market a bit less attractive. As the economy has stabilized the last few weeks, we’ve seen rates creep back up. We will be cautious and patient in this market right now to see how rates stabilize and continue to watch economic data develop to see where Fed and market expectations play out.

The Path(s) Forward

All this leads to what’s next for the markets. In our view, and at a very high level, there seems to be two paths forward. The first path is continued economic strength and the second path would be a slowing economy, mainly driven by concerns over a banking crisis and tightening of the credit markets. Now there would obviously be much more nuance to any situation, but in both cases, you could make the argument that they would be optimistic to the markets. However, it wouldn’t have the same outcome for all areas of the stock or bond market, and we’d want to choose our allocations wisely.

Continued strength in the economy would most likely include a “higher for longer” interest rate environment from the Fed. This was our thesis before everything happened with SVB. We felt that the economy was strong, inflation was coming down but still had elements of stickiness that would persist, and the Fed wouldn’t want to reverse rates too quickly. To us, this would help support stock valuations and we would want to hold quality & profitable companies during this time. It would also be good for the fixed income market as rates would stay higher longer adding additional yield to the portfolio.

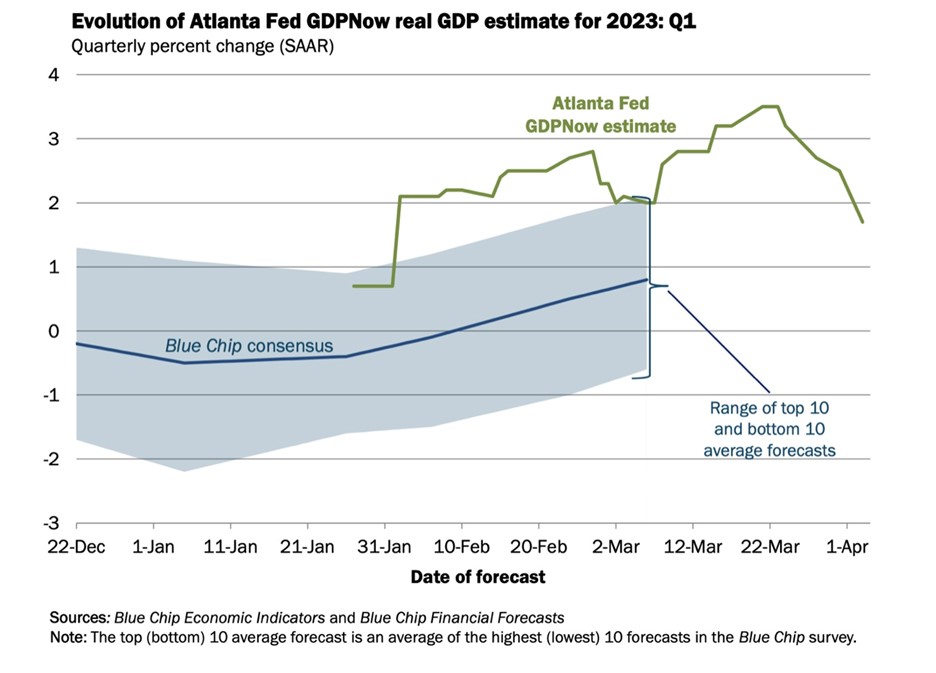

The other path from here is that the economy begins to slow, with a big emphasis on the financial sector. Should this be the case, it could be another bullish case for stocks as we’ve seen over the past 3-4 weeks, with the continued chance of short-term volatility. The market would embrace a pivot by the Fed and could drive stocks higher from here. If it is a run of the mill type economic slowdown or recession, odds are most of that has been priced in during 2022’s bear market. Remember, the stock market and economy don’t always move together. Last year’s stock market selloff was in anticipation of a future recession. We could still have a slowing economy (which honestly, we are in the midst of already) without hitting the lows we last saw in October of 2022. The markets are forward looking and the last thing we want to do is wait for positive headlines. But as you can see, the last few weeks have brought down economic expectations with the market continuing to rise.

Now there is always a third path here. That is the risk of the unknown. Remember, things happen all the time that have never happened in history before. In that case, there is always the risk of something more extreme that oftentimes we cannot predict and don’t see coming – Covid as an example. This path is always on the table, and the best way to manage this risk is by proper allocation, protection of short-term spending needs, and appropriate financial planning. If we do all these things right, we can manage and get through those uncertain times. In terms of what we can see now, we continue to hold on to that cautious optimism.