Net Unrealized Appreciation: Pay Less in Taxes on Employer Stock in your 401(k)

Written by: Vincenzo Testa, CPA, CFP®

Building wealth is a goal that many individuals strive for throughout their lives. One of the avenues through which people accumulate wealth is by investing in employer-sponsored retirement plans, such as 401(k)s. These plans offer a range of investment options, including stocks and even company stock. One aspect of retirement planning that often goes unnoticed but can significantly impact your financial future is Net Unrealized Appreciation (NUA).

In this blog, we will explore:

- What is Net Unrealized Appreciation (NUA)?

- The NUA Distribution Strategy

- The Benefits of NUA

What is Net Unrealized Appreciation (NUA)?

Net Unrealized Appreciation, or NUA for short, is a tax-advantaged strategy available to individuals who hold their employer's company stock within their employer-sponsored retirement plan, typically a 401(k). NUA allows you to take advantage of potential tax benefits when distributing your employer's stock from your retirement account.

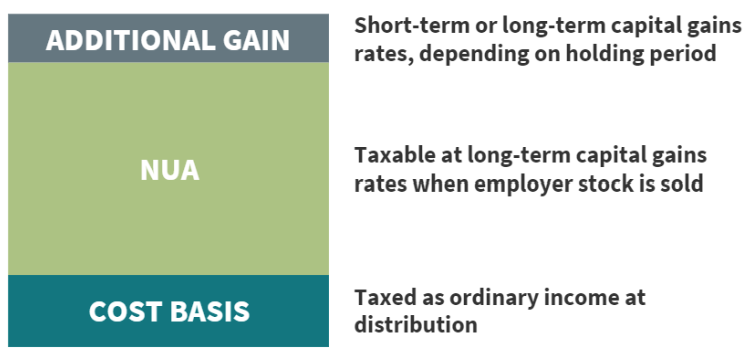

Here's how it works - Suppose you have company stock in your 401(k) plan, and this stock has increased in value since you acquired it. The difference between the current market value of the stock and its cost basis (the original price you paid for it) is the NUA. This appreciation is considered "unrealized" because it has not yet been taxed.

The NUA Distribution Strategy

To benefit from NUA, you must follow a specific distribution strategy. Here are the key steps involved:

- Retirement Plan Distribution: When you retire or leave your job, you can choose to take a lump-sum distribution of your retirement plan assets. This distribution includes both the company stock and any other assets in your plan.

- Separate the Company Stock: After the distribution, you must separate the company stock from your other retirement plan assets. Typically, this involves transferring the stock to a taxable brokerage account.

- Pay Ordinary Income Tax: The cost basis of the company stock (the original purchase price) is subject to ordinary income tax in the year of distribution. This means you'll pay income tax on the cost basis but at your regular tax rate.

- Hold onto the Stock: You have the flexibility to hold onto the company stock as an investment or sell it immediately. If you sell the stock right away, any gains above the cost basis will be subject to capital gains tax.

The Benefits of NUA

Now that we understand the NUA distribution strategy, let's explore the potential benefits it offers:

- Tax Deferral: NUA allows you to defer taxes on the appreciated value of your company stock until you decide to sell it. This tax deferral can be particularly advantageous if you expect to be in a lower tax bracket after retirement.

- Lower Capital Gains Tax: When you eventually decide to sell the company stock, the appreciation above the cost basis is subject to capital gains tax rather than ordinary income tax rates. Capital gains tax rates are typically lower than income tax rates for most taxpayers.

- Diversification: By transferring the company stock to a taxable account, you gain more control over your investments and can diversify your portfolio. This helps reduce the risk associated with having a significant portion of your retirement savings tied up in a single stock.

- Estate Planning: If you choose to hold onto the company stock until your passing, your heirs may receive a step-up in cost basis, potentially reducing their capital gains tax liability when they eventually sell the stock.

Consult a Financial Advisor: NUA can be a complex strategy with significant tax implications. It's highly advisable to consult with a qualified financial advisor or tax professional before implementing it to ensure it aligns with your overall financial plan. If you have any questions regarding your Employer Stock Compensation, please contact us for guidance.

Conclusion

Net Unrealized Appreciation is a valuable but often overlooked strategy for optimizing your retirement savings and managing your tax liability. By understanding how NUA works and consulting with experts, you can make informed decisions that can potentially unlock wealth and provide financial security in retirement. Remember that financial planning is a personalized endeavor, and what works best for one individual may not be suitable for another, so it's crucial to tailor your approach to your unique circumstances and goals. For additional information on Employer Stock Compensation, read our blog about Planning Around Employee Stock Options.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.