Navigating Student Loans: Repayment Options and Strategies

Written by: Scott Strohecker, EA

Introduction:

Entering the world of higher education often means taking on the financial responsibility of student loans. While pursuing education is important for personal and professional growth, managing the repayment of student loans can be a daunting task. Understanding the various repayment options and implementing effective strategies can significantly alleviate the burden. Since March 13th 2020, this burden has been on pause thanks to US Department of Education’s COVID-19 relief. This relief automatically paused student loan payments and set the interest rate to 0%. However, this pause has officially ended on September 1, 2023, with payments starting again in October.

Let's delve into some key insights on how to navigate student loans and ensure a smoother repayment journey:

- Understanding Repayment Options

- Strategic Approaches to Repayment

- Staying Informed and Seeking Assistance

Understanding Repayment Options:

1. Standard Repayment Plan: The most common approach, this plan involves fixed monthly payments over a period of 10 years.

2. Income-Driven Repayment Plans: These plans adjust monthly payments based on the borrower's income, making it more manageable for those with lower incomes. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

3. Refinancing and Consolidation: Refinancing involves obtaining a new loan with better terms to pay off an existing one, often resulting in a lower interest rate. Consolidation, on the other hand, combines multiple loans into one, simplifying the repayment process.

Strategic Approaches to Repayment:

1. Budgeting and Planning: Creating a comprehensive budget and financial plan is crucial. By prioritizing loan payments and minimizing unnecessary expenses, borrowers can ensure timely repayments.

2. Exploring Forgiveness Programs: Investigating loan forgiveness programs, especially those catering to specific professions or public service, can provide opportunities for partial or complete loan forgiveness. There are several loan forgiveness programs offered by the Federal government and New York State.

3. Making Extra Payments: Allocating extra funds towards loan repayment whenever possible can help reduce the principal amount and decrease overall interest costs.

Staying Informed and Seeking Assistance:

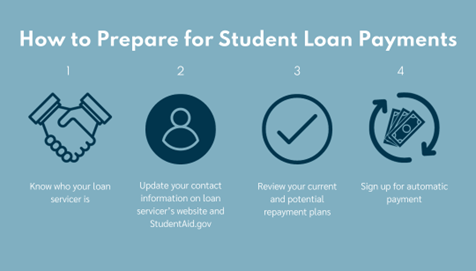

1. Staying Updated: Keeping abreast of any changes in loan policies, interest rates, and other relevant information is vital for effective loan management. Are you prepared for the recent payment restart?

2. Seeking Professional Guidance: Consulting financial advisors or loan counselors can provide valuable insights and personalized guidance tailored to individual financial situations.

Conclusion:

While repaying student loans may seem challenging, understanding the available options and implementing strategic approaches can make the process more manageable. By staying informed, creating effective repayment strategies, and seeking professional advice when needed, borrowers can navigate the complex landscape of student loan repayment with greater confidence and ease.

If you would like to strategize about your repayment options, please contact our office to set up an appointment.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.