Emergency Funds: Why You Need One & How to Build It

Written by: Catherine (Katie) Buck

The basic financial advice for young adults is building an emergency fund to take care of those unexpected medical bills or car repairs and making sure you’re taking advantage of the employer match in your 401(k). However, there is a new behavioral trend towards money, a view shared mostly by younger generations, that encourages people to spend more and save less known as “soft saving”. Negative sentiment towards the higher standard of livings costs, larger debt balances, and unprecedented current events have some convinced that saving for retirement is futile and life should be enjoyed to the fullest. In this blog, I hope to encourage people to take the take control of their finances and gain some peace of mind through building an emergency fund and investing early.

Topics covered in this Blog:

- What is soft saving.

- What is an Emergency Fund.

- The Benefits of Compound Interest.

Soft Saving

Soft saving is a trend where young adults around the ages 18-25 prioritize quality of life versus grinding out an early retirement. Young adults often feel disillusioned as they face high inflation and ever-increasing costs of living while carrying generational amounts of student loan debt. In some cases, they feel as if they will never be able to save enough to fully retire. Therefore, instead of living a frugal lifestyle, they decide to live in the present and enjoy their cashflow to the fullest. Unfortunately, soft saving might be adversely impacting young investors by failing to leverage the benefits of compounding and leaving them vulnerable to incurring additional debt.

Emergency Funds

An emergency fund is 3-6 months of expenses set aside for unexpected expenses. Usually, these costs are unforeseen medical expenses, car repairs or home maintenance. This financial cushion helps avoid incurring additional debt, especially debt with higher interest rates. Having an emergency fund creates smoother budgeting, allowing for allocation towards financial goals, paying down debt or saving for a home. Emergency funds are readily accessible. Balances maintained in retirement plans like a 401(k) or IRA may be subject to withdrawal penalties. Lastly, an emergency fund can provide peace-of-mind against life’s uncertainties, greatly reducing the emotional toll of the unknown.

Compound Interest

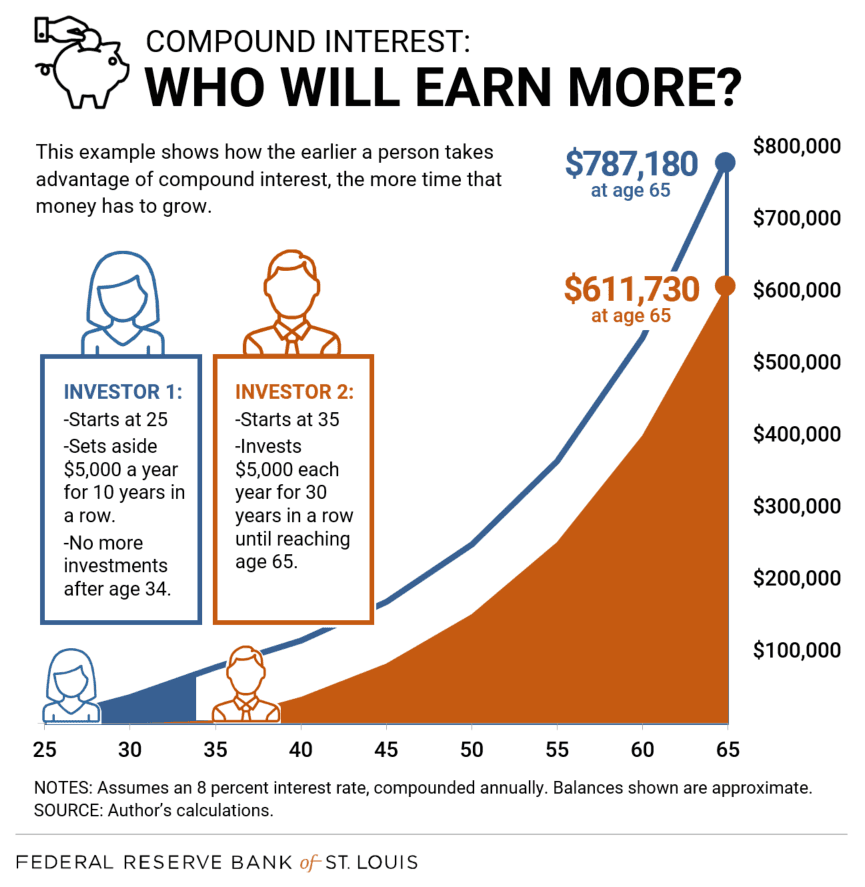

As a young adult, the power of compound interest can make even the smallest of investments appreciate exponentially long-term. Simply put, compound interest involves the reinvestment of earnings back into the investment. This continuous cycle of reinvestment contributes to the compounding effect, creating a self-reinforcing mechanism for wealth accumulation. The most important part of the equation is time, starting early and allowing compound interest to work its magic can produce returns incomparable to those who invest later in life in greater amounts. We recommend everyone take advantage of any employer retirement plan matches. For young adults, contributing a total of 10%-15% (including the employer match) is recommended. However, any contributions up to and over the employer match is beneficial if you cannot contribute up to the recommended amount. For those interested in seeing the power of compound interest relevant to their particular situation you can use this compound interest calculator provided by the S.E.C.

Conclusion

Although young adults may feel retirement is unattainable in this economy, there are some small, yet effective steps they can take to improve their financial health. Setting up an emergency fund with 3-6 months of expenses and taking advantage of employer retirement plan matches can help with their current and future standard of living. If you have questions and would like to discuss your or a loved one’s financial future, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.