Beating the Odds: Preserving Family Wealth through Generations

Written by: Harmony Wagner, CFP®, CPWA®

Introduction

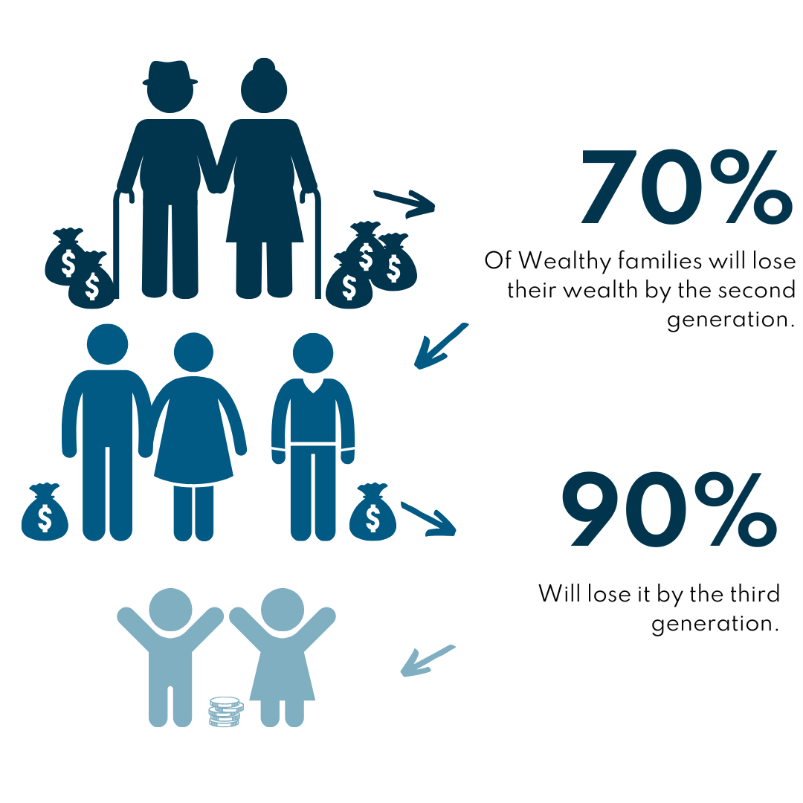

For many people, their children and grandchildren are their “why” when it comes to building wealth. The motivation to work hard and save money throughout their careers is to set their children and grandchildren up for a better financial life than they may have experienced otherwise. Unfortunately, statistics suggest that when it comes to actually transferring wealth to future generations, the success rate for most families is quite low.

The adage “shirtsleeves to shirtsleeves in three generations” is a phenomenon that exists not only in American households, but in many different cultures around the world. The research shows that 90% of wealth will be lost within three generations. Practically speaking, for any first-generation wealth individuals or couples, there is only a 10% chance that their grandchildren or beyond will share in any of that.

Why is this phenomenon so prevalent globally and what are the factors that lead to wealth erosion over a relatively short period of time? According to a study by the Williams Group, 60% of family wealth transfers fail due to breakdown of communication of trust, while an additional 25% of failures are due to inadequate preparation of younger generations. The other 15% is due to other causes, such as taxes or legal issues. Most of these reasons are avoidable with proper planning, so taking steps towards preventing these communication, preparation, and administrative issues is a key part of a successful wealth transfer strategy. This blog will cover some strategies that families can take to prepare younger family members to preserve and grow wealth.

Strategies for Family Wealth Preservation:

- Start young.

- Keep open lines of communication.

- Hold a family meeting.

- Involve trusted professionals.

Start young.

Research suggests that the optimal age for young people to start receiving financial education is between 7-14. Unfortunately, prudent financial management is not being adequately taught in schools, so many young adults’ graduate high school ill-equipped to make wise decisions about higher education, career path, and financial management. By age 30, an individual’s money management habits are established and much harder to change, so it is most effective to teach school-age children and give them opportunities to manage their own finances on an age-appropriate level.

Keep open lines of communication.

Money can be a taboo subject, even when it comes to the closest family relationships. Some parents and grandparents may worry that their children or grandchildren are not mentally ready to hear how much they stand to inherit, so they do not reveal that information during their lifetimes. Unfortunately, this approach leaves the heirs unprepared and alone after their older relatives have passed away, leaving them with significant wealth, but a lack of skills needed to protect it. An alternative approach would be to emphasize preparation first, and communication second. If younger family members are not ready to handle all the information, financial education is a great place to start. From there, older family members can begin involving their children and grandchildren in the financial management on a small scale, perhaps through strategic gifting of small amounts, until they feel confident that their future heirs are ready to understand the full scope of the family wealth that will one day pass down to them. Because this approach can take many years, it’s key to start as early as possible to allow for a successful passing of the baton.

Hold a family meeting.

Having a family meeting is a great way to make sure everyone is on the same page financially speaking, and to allow a forum for all family members to express their perspectives, values, and concerns about money. The older generations may choose to share details about the family wealth and can express their financial legacy wishes. Younger generations can ask questions, share their values, and get involved with financial management alongside their parents and grandparents while all parties are still alive and actively engaged. These meetings can also be a great time to designate roles, such as estate administration, POA and/or trustee duties, charitable involvement, responsibilities within the family business, etc.

Involve trusted professionals.

If you have a trusted financial advisor, you may want to consider bringing that individual or team to the conversation. Depending on the family dynamics and level of complexity, other professionals, such as family counselors or estate attorneys, may also be able to help facilitate these ongoing family discussions around money. An objective third-party advisor can provide expertise, facilitate healthy conversations, present topics that may not have been considered by the family themselves, and build relationships with all generations. This step may go hand in hand with a family meeting for those who choose that route. In other situations, the financial advisor may reach out to younger family members to set up advisory conversations separately. Financial advisors and attorneys are the people who are most likely to guide family transitions as upper generations pass away and wealth moves down, so it is beneficial to build those trusted relationships prior to a major family event such as the loss of a loved one.

Conclusion.

While building generational wealth is important to many American households, family wealth transfers are unlikely to be successful without intentionality and communication. By implementing one or more of these steps, families can avoid some of the common pitfalls and set future generations up for financial success. At Bouchey, we are committed to helping our clients and their families preserve and grow wealth for many generations. If you are interested in learning more about estate planning or unsure of where to start, watch our webinar on Estate Planning. Or, if you’d like to learn more about our expertise on family wealth and how we can help for your specific needs contact us.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.