Are I Bonds Still A Good Investment?

Written by: Paolo LaPietra, CFP®

I Bonds have been an extremely popular investment vehicle for Americans since 2021 with the spike in inflation that we have seen in the economy. To put into perspective on how sought after I Bonds have been, more than 3.7 million accounts were opened to purchase I Bonds in 2022 alone. This is more than the prior ten years combined. Considering that I Bonds were created to protect investors from inflation, this upsurge makes sense.

This article will discuss:

- How I Bond Yield is Calculated

- Alternatives in our Current Environment

How I Bond Yield is Calculated

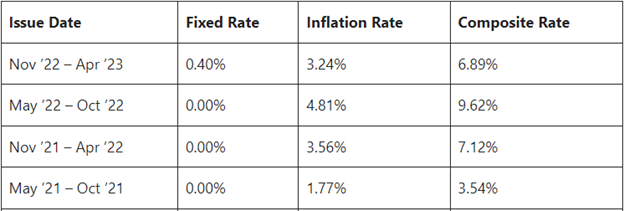

The yield an investor earns from an I Bond is calculated from two different components, the fixed rate and inflation rate. The lackluster fixed rate on an I Bond is the yield that is guaranteed throughout the time an investor holds onto it. The coveted aspect of an I Bond is the inflation rate which is directly tied to the Consumer Price Index (CPI) and changes for the investor every six months. The fixed rate and inflation rate on I Bonds are set every six months, November 1st and April 30th. Below are the historical rates for I Bonds over the last two years:

As you can see, I Bonds yielded the highest at 9.62% between the May ’22 to October ’22 series as CPI hit its most likely peak in the summer of 2022. Inflation has been steadily trending down since the summer of 2022 and continues to show signs of cooling. We can see the direct effect of this on I Bond yields as the current composite yield, which is the combination of the fixed rate and inflation rate, offered is 6.89%. With the next six-month series coming up on April 30th, it’s estimated that I Bond yields will drop to nearly 4%. This raises the question; should I still be buying I Bonds?

Alternatives in our Current Environment

One of the positive attributes of the Federal Reserve (FED) aggressively raising interest rates since the beginning of last year is the yield investors can now earn on stable investments. Money market funds, such as the Schwab money market fund SWVXX that we utilize for our clients, are currently yielding over 4.5%. Money market funds allow investors full access to their money while picking up an attractive yield. If an investor is comfortable with locking up their money for a period of time, then Certificate of Deposits (CDs) or US Treasuries are a viable alternative as well. US Treasuries are currently yielding as high as 5.12% for a 3-month lock-up period. But what if you already own an I-Bond?

While it’s challenging to say where inflation will go from here, the evidence of inflation waning has been building since the summer of last year. If you are in the camp that the FEDs fight against inflation will prevail and bring inflation back down to their target of 2%, then I Bond yields will become undesirable compared to other stable yielding investments.

Before an investor goes off and sells their I Bond to invest in a Money Market or Treasury, there are some timing scenarios to consider.

- First, investors that purchase an I Bond need to hold it for at least one year.

- For investors that have held their I Bond for over a year but less than five years, they will give up three months’ worth of interest earned if they sell their I Bonds. With the new composite rate being set on April 30th, investors should be strategic on which three months of interest they are going to give up. If the composite rate does drop to 4%, it would be prudent to wait to collect 3 months of the 4% interest to ensure those would be the months of interest you would give up, rather than giving up the current 6.89%.

Conclusion

Regardless of what your views are on inflation, whether you think inflation will remain sticky and I Bonds will continue to offer attractive yields or you are in the camp that inflation will come back down to it’s 2% target rate making I Bond yields inferior compared to other areas of the fixed income market, investors should hold onto their I Bonds until April 30th when we learn what the new composite rate will be for the next six months.

If you found this topic useful and would like to schedule a follow up call, please contact our team.

You can learn more about Series I Bonds in Martin Shields' article: Series I Bonds – The One Thing That Improves With Inflation

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY, and Boston, MA.