7 Financial Tips for New Parents

Written by: Samantha Masey, CFP®

As soon to be first-time parents, my husband and I are in the middle of preparing for our baby to arrive and all the details that entails. Having a baby is an exciting and joyful time, but we have also encountered some unexpected considerations in preparation for her. These have ranged from the cost of baby gear to setting up health insurance. This article dives into our journey of preparing for parenthood and 7 financial tips we found helpful along the way.

7 Financial Tips for New Parents

- Create a household budget

- Determine first-time baby purchases

- Update insurance coverage

- Consider potential tax benefits

- Update or create estate planning documents

- Plan for college

- Don’t forget to prioritize your retirement savings

1. Create a Household Budget

Having a child certainly changes spending habits by adding extra expenses we never had to consider. Our first step was to identify which areas would change in terms of both income and expenses. For some couples it might mean your income is cut in half as one of you becomes a stay-at-home parent or your expenses might jump up as you need to plan for daycare expenses. In fact, 72% of parents spend more than 10% of their annual income on childcare and the average cost of childcare in New York is $15,371. First time parents also need to consider the regular costs of supplies like diapers, baby formula and other care products. Once we had established a household budget, we were able to discuss what was feasible for our situation and begin to plan ahead. A recent study concluded that on average, it costs ~$18,000 per year to raise a child.

Another consideration is to increase your emergency fund. The general rule of thumb is to set aside 3-6 months’ worth of expenses for emergencies. When you start a family, your expenses increase so your emergency fund should increase as well.

2. Determine First-Time Baby Purchases

In addition to regular care expenses, first-time parents can expect to shell out a large amount of savings on purchasing one-time equipment needed for their child and preparing their home. You’ll have to consider furniture, clothes, car seats, and much more. I was shocked by the amount of supplies we “needed” according to the internet. What helped me narrow down the list was speaking with other young moms about what they thought was necessary and what was a waste of money. Even with these recommendations, my list quickly became expensive. You will also want to estimate your out-of-pocket hospitalization and delivery expenses. I recently read a stat that said the first year of your child’s life is the most expensive with parents needing to purchase $20,000-$40,000 worth of goods. Estimating these one-time baby expenses ahead of time can be helpful when budgeting for the items you need.

Great Tool: First Year Baby Costs Calculator

3. Update Your Insurance Coverage

The next surprise we encountered was that a parent-to-be is expected to set up their baby’s health immediately after their birth. This means contacting your health insurance provider about the additional coverage and premium costs. You do have a grace period of applying for coverage within 60 days after your baby’s birth, but it is better to be ahead of the game and look into your insurance options now to have a plan in place.

You also want to consider risk management through life insurance. It is a good idea to purchase enough life insurance to cover any immediate debts, income replacement for a reasonable amount of time, and future goals like college for your child.

4. Consider Potential Tax Benefits

In general, when you decide to grow your family tax benefits are not on your mind. However, it is an area that will have a positive impact on your financial life if you and your child qualify. I recommend working with your tax preparer and financial advisor to make sure you are taking advantage of your available benefits.

Tax code provisions for parents

- Secure Act 2.0 – A provision was created that allows parents to withdraw up to $5,000 from retirement accounts, penalty-free, within a year of birth or adoption for qualified expenses.

- Child Tax Credit – This tax credit helps families with qualifying children get a tax break. In 2023, the credit provides a maximum of $2,000 per qualifying dependent child under age 17. The annual income threshold is $200,000 for single taxpayers ($400,000 if filing jointly).

- Child and Dependent Care Credit – If you paid someone to care for your child or other qualifying person so you (and your spouse if filing jointly) could work or look for work, you may be able to take the credit for child and dependent care expenses. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. Learn more about this credit on irs.gov.

5. Update or Create Estate Planning Documents

In my experience, this stage of life is often the first time a person will begin thinking about their estate plan. It’s important to begin determining who will take care of your child if something happens and how your finances will be handled. I recommend having a discussion with an estate attorney and figuring out what is necessary for you.

It is recommended that you set up or update your:

- Will

- Guardianship Designation

- Healthcare Proxy

- And Durable Power of Attorney

6. Plan for College

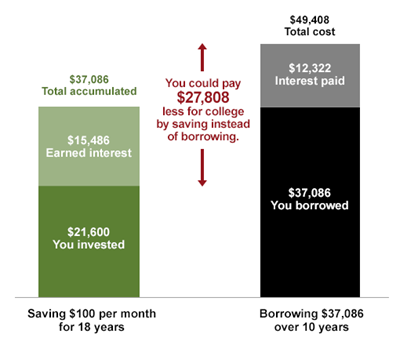

Believe it or not, beginning to save for your child’s future education can have impactful results if you start immediately. A popular savings vehicle is NY’s 529 plan which invests your funds in the appropriate risk profile and offers great flexibility for qualified distributions. A recent development of these plans allows you to transfer up to $35,000 of unused funds to a Roth IRA if your child does not end up using them for qualified educational expenses. With college expenses increasing every year, you can help set up your child for success by providing some of their tuition due instead of having them borrow the full amount. The illustration below shows someone who saved $100 per month for 18 years earning 6% average annual investment earnings compared to what they would pay if they borrowed the same amount. These results become more impactful if you save more over the years.

7. Don’t Forget to Prioritize Your Retirement Savings

In the flurry of preparing for your child, it can be easy to forget about yourselves and long-term goals. My last tip for new parents is to continue to diligently save for your own retirement and not to sacrifice on this front for other short-term goals. Your budget is going to become tighter with all of the new expenses we discussed, but someday you will still need to retire. To keep yourselves on track, aim to save 10-15% of your household income in employer plans. I recommend working with a fiduciary financial advisor to make sure your savings are on track.

If you would like to have a conversation about your particular situation, please schedule a meeting with our team.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.