Today’s Inflation, The FED & Market Recap

Written by: Paolo LaPietra, CFP®

Whether you have been listening to the news or talking with friends and family, inflation has found it’s way into the conversation. It makes sense, inflation affects so many aspects of our lives. While stopping at the gas pump, shopping in the grocery store, or in the market for a new car or home, we’ve seen prices drastically increase. This comes as a shock for the US consumer that hasn’t really seen spiked inflation since President Carter.

Whether you have been listening to the news or talking with friends and family, inflation has found it’s way into the conversation. It makes sense, inflation affects so many aspects of our lives. While stopping at the gas pump, shopping in the grocery store, or in the market for a new car or home, we’ve seen prices drastically increase. This comes as a shock for the US consumer that hasn’t really seen spiked inflation since President Carter.

This article will discuss:

- The rise in inflation

- Consumer Price Index

- The FED’s current monetary policy

- How the Bond & Stock Market are reacting

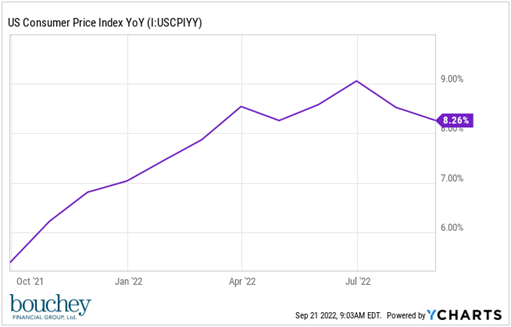

The graph below shows an 8.26% increase in inflation from a year over year prospective. To put this into context, the Federal Reserve’s goal is for 2% core inflation.

CPI

The Consumer Price Index (CPI) measures the change in prices that the US consumer pays. This data is collected by the Bureau of Labor Statistics (BLS). CPI is broken down into two main categories: Core and Headline. There are 8 major groups of CPI: Housing, Apparel, transportation, education, medical care, recreation, food and beverages, and services. Core inflation removes inputs that are seen as more volatile. The two biggest examples of this would be food and energy prices. Headline inflation, which includes food and energy, is a stronger representation of what the cost of living is for the US consumer.

The FED

CPI data is something the Federal Reserve looks at closely to determine the monetary policy for the US economy. Monetary policy is a tool the FED can use to influence the country’s money supply and consumer demand in the economy. When inflation is too high, the Fed will begin tightening their monetary policy. The FED is currently doing that now by raising the short-term interest rates known as the federal funds rate. When the FED raises short term interest rates, this makes borrowing more expensive for consumers and discourages them from borrowing. On the other side of the equation, saving rates start to increase, encouraging consumers to start saving more in conservative investments. Since consumers will start borrowing less and saving more, this will bring down the overall money supply in the economy and the demand for goods and services, thus bringing down the overall prices in the Consumer Price Index.

Bond & Stock Market

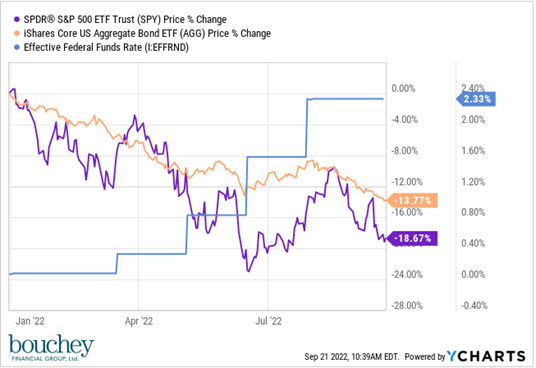

A tightening in monetary policy can create volatility in the bond and stock market in the short term which investors are currently experiencing now.

The chart above shows how the Federal Funds Rate has increased (highlighted in blue) and the US Aggregate Bond index (highlighted in orange) and the S&P 500 (highlighted in purple) have declined during the year.

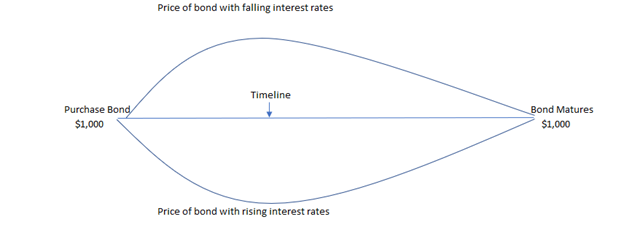

Bond prices have an inverse relationship to interest rate movements. The graph below does a great job of depicting this.

Stock valuations can also struggle in a rising rate environment due to the Discounted Cash Flow (DCF) model. The DCF model uses two key metrics: (1) the future cash flows to be generated by a company or the market and (2) the discount rate (US 10-year treasury yield) used to discount cash flows to be received in the future to today’s present value. To put this simply, as treasury yields rise, this lowers the value of future cash flows for a company and thus leads to a lower company valuation.

For the remaining months of the year, the monthly CPI report will continue to be extremely important for the markets and the economy. September's CPI report will be released on October 13th. Until inflation shows consistent change in slowing down, the FED will continue to be restrictive in its monetary policy which will remain a challenging environment for stocks and bonds. If you have questions, please feel free to reach out to our team of advisors who would be happy to continue the conversation.

Related Reading:

- Testing the Lows

- Sink or Swim – How the Sunk Cost Fallacy Could Be Affecting Your Investment Decisions

- Inflation Reduction Act of 2022

Bouchey Financial Group has local offices in Saratoga Springs and Historic Downtown Troy, NY.