7 Questions to Ask a Potential Financial Advisor

Written by: Samantha Masey, CFP®

Choosing a financial advisor can be an intimidating process full of unfamiliar terminology, designations, compensation and more. This leaves many people unsure about where to begin their search. It is important to find a wealth advisor that you not only trust but who also suits your investment and financial planning needs. This article provides 7 questions to help you narrow down your list and find the right advisor for you.

7 Essential Questions to Ask a Potential Financial Advisor

- Are you a fiduciary?

- How do you charge fees?

- What are your qualifications?

- What is your investment philosophy and strategy?

- How is your client retention rate?

- How do you communicate with clients?

- What is it like to be a client of your firm?

1. Are you a fiduciary?

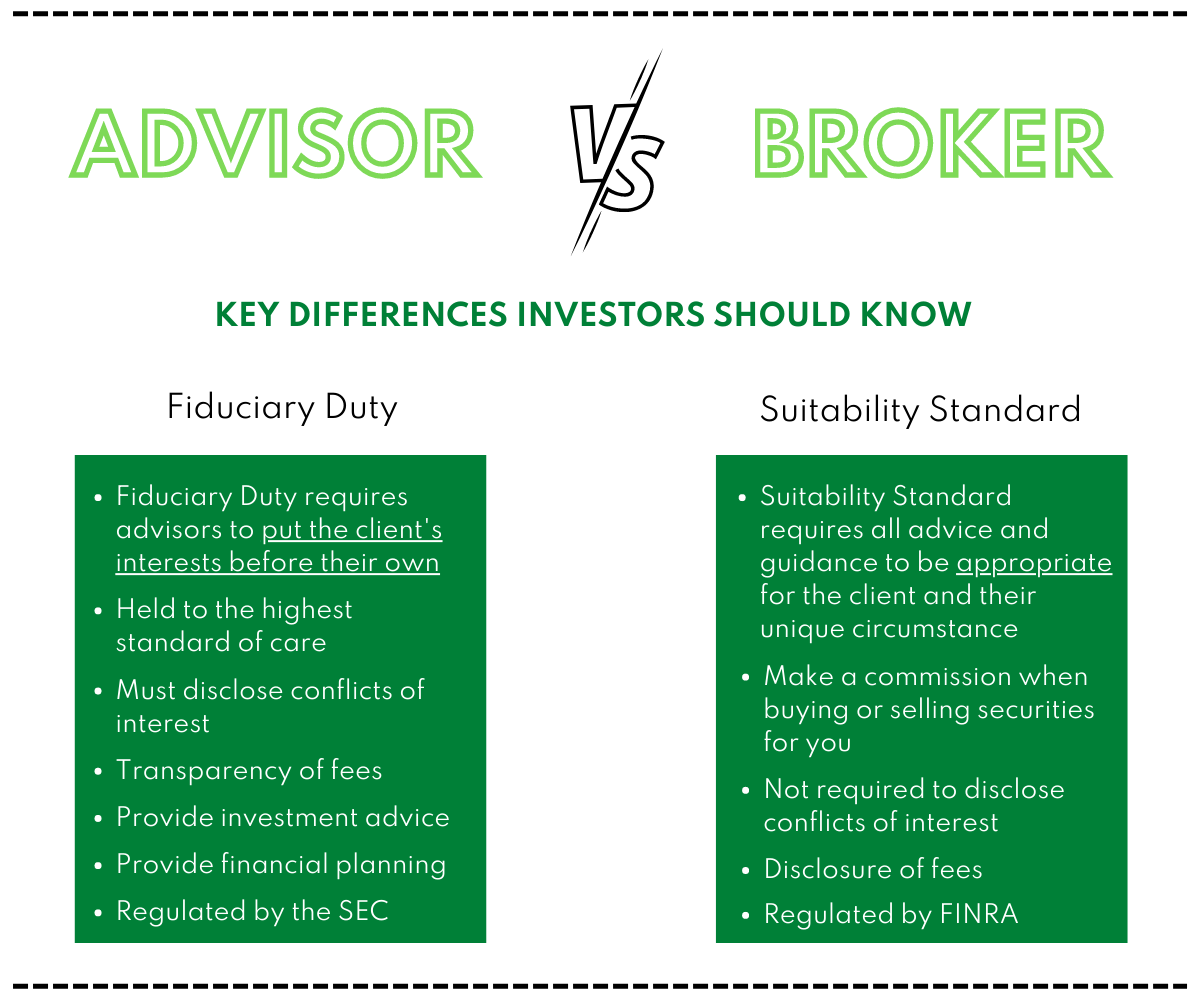

Finding a fiduciary should be one of the top priorities when seeking a financial advisor. A fiduciary’s responsibility is to put the interests and wellbeing of a client before their own. Practically, this looks like the removal of conflicts of interest and establishes a basis of trust. All others must meet a “suitability” standard as defined by FINRA rule 2111. This standard states that any advice or guidance needs to be appropriate for the client and their unique circumstances. However, they are not required to act in the best interest of their clients which allows for the opportunity to recommend strategies that pay commission. The below comparison provides a visual of the main differences between a financial advisor and a broker.

2. How do you charge fees?

There are several ways an advisor can make money, but not all compensation structures are created equal. The three most common structures are:

- Fee-Only

- Fee-Based

- Commission-Based

Fee-only firms earn compensation based on services performed for a flat fee, hourly rate or percentage of assets under management. A typical percentage is around 1% of a client’s portfolio annually. This fee structure is preferable because the advisor is most likely to be unbiased and be objective with investment advice.

Fee-based describes a combination of fee-only and commission-based. A fee-based advisor or agent receives compensation directly from client fees but can also receive sales commissions on products they sell. Most fee-based advisors are fiduciaries and therefore any products they sell must be in the client’s best interest.

Commission-based advisors or agents can receive incentives from an investment provider when they sell a product or service to a client. This often includes the sale of insurance policies, stocks or mutual funds. Most commission-based financial advisors work for major firms that may seem like they have unlimited resources, but often they are operating as independent contractors within this structure.

It is important to understand the differences and make a decision that is best for you. We recommend choosing a fee-only financial advisor who will act as a fiduciary on your behalf.

3. What are your qualifications?

When it comes to trusting an advisor with your finances, it is important to make sure you have qualified, competent professionals on your team. Look for financial advisors that are a Certified Financial Planner (CFP), Certified Public Accountant (CPA) or Charted Financial Analyst (CFA). Each of these prestigious credentials are bound by rigorous requirements and report to their respective boards for practice standards and codes of ethics. Not only should the advisor or advisory team have a breadth of knowledge, but they should also have a depth of experience. Work with a team that has a strong work history of success and client retention. You can look for client reviews online or ask people you know about their reputation.

A finance professional can be a financial advisor without the certifications discussed. Look for:

- CFP®

- CPA

- CFA

Lastly, if the firm you are considering is a Registered Investment Advisor (RIA) it has a fiduciary responsibility to its clients and has demonstrated technical proficiency and industry knowledge. You can look up advisor and firm backgrounds at: https://adviserinfo.sec.gov/ or https://brokercheck.finra.org/

4. What is your investment philosophy and strategy?

Each advisory firm will have a unique investment policy that may or may not be in line with what you are looking for. When times are tough and market returns are below expectations it can be hard to stay the course, but if you believe in the strategies your advisor has implemented for you, you are more likely to stay on the same page.

You should also ask about the financial advisor’s investment preference between mutual funds, ETFs and individual stocks. Other items to be mindful of are management fees, liquidity, performance, and levels risk.

5. How is your client retention rate?

In general, it is not a positive sign if client retention is low for an advisor. This would mean that clients have chosen to seek other financial advisors or firms after a period of time. A good benchmark is the industry client retention rate which rose to a high of 94.6% in 2020.

The most frequent reasons clients change advisors are related to:

- Poor communication or customer service

- Poor performance

- High fees

- Stagnant advice

As you interview financial advisors, keep these factors in mind and try to understand if these would be potential problem areas if you moved forward with the relationship. In our introductory conversations, we do our best to provide total transparency so potential clients understand exactly how we operate and how we mitigate these risks for them.

6. How do you communicate with clients?

As just discussed, a lack of communication is one of the main reasons clients will change financial advisors. Some reasonable expectations would be communication when trades are made in your portfolio, meeting 2-4 times per year, and learning opportunities such as webinars or blogs. It is important that the advisor you choose communicates in both the good and bad times.

We often say an educated client is the best client. We aim to equip our clients with educational resources and build a foundation of trust as we manage their portfolios. If clients and advisors can work in tandem a long-term plan can have great success.

7. What is it like to be a client of your firm?

Discuss your expectations for the relationship. How often would you like to meet? Does the advisor meet in person or mostly via Zoom? As a client, get a sense if the advisor will be accessible to you and if you can call in and speak with a person during office hours. Will your relationship be siloed with this one advisor, or will you work with an entire team? These are all important questions to communicate to see if you are a good fit.

You should also have clear discussions about investment and financial planning services. A wealth advisor will offer a comprehensive suite of services while investment advisors will solely focus on your portfolio.

Summary

Choosing a financial advisor and advisory firm is an important step toward aligning your financial future with your goals. The discussed questions will help you sift through the mountain of information available and find your best match. Some professional tips for those actively seeking a financial advisor are:

- Seek out a fiduciary

- Consider fee-only advisors

- Look for CFP®, CPA or CFA credentials within a firm

- Have an in-depth and transparent conversation about investment philosophy

- Look for advisors that are highly recommended with high client retention rates

- Choose an advisor with active and frequent communications

- Establish how you would like to work with the advisor and make sure it is a good fit

Above all, you need to trust the expertise and integrity of your advisor. If this information has prompted you to seek out a financial advisor or you would like to discuss the questions further, our team of wealth advisors is just a call away. Call our office at (518) 720-3333 or contact us for more information.

Bouchey Financial Group has local offices in Saratoga Springs and Downtown Historic Troy, NY.