5 Personal Finance Strategies During High Inflation

Written by: Harmony Wagner, CFP®

With inflation at 40-year highs, American households are feeling the pinch. For April and May, the year-over-year inflation figures were 8.3% and 8.6% respectively, and with issues on both the supply and demand side of inflation, many people fear that inflation may persist through the summer months and perhaps even beyond, despite action by the Federal Reserve to try and rein it in. The average consumer can’t do much to affect inflation on a broad scale. However, there are some personal finance strategies that may be advantageous during high inflationary environments such as the one we are experiencing currently.

1. Invest In Equities

Inflation can deliver a shock to equity markets, and the resulting turbulence may cause nervous investors to consider keeping their nest egg in cash under the mattress. During high inflationary environments, many people wrestle with the question: “Should I be invested right now?”

The average return of the S&P 500 overtime is 10%, which is higher than the inflation we are seeing now. In addition, the median real rate of return over a two-year time frame following a period of high inflation is 18.5%, which is only .2% lower than the two-year returns after periods of low inflation1. If that’s not motivation enough to maintain exposure to equities, the alternatives to equities are often especially unattractive. Bonds are negatively impacted by high inflation as the real value of future income payments decreases. Cash loses its value slowly and silently as inflation eats away at its purchasing power.

Some sectors of the equity market, such as energy or industrials, tend to outperform other sectors when inflation soars. As tempting as it may be to make a dramatic move toward those sectors, it is crucial to keep a long-term mindset and to remain diversified across the equity market. The sectors that outperform during high inflationary periods may not be strong performers in the future when inflation comes down. Any tactical moves should be made in a disciplined manner with the bigger picture in mind, and this is where a trusted investment advisor can add significant value.

For investors looking for a secure, inflation-protected investment, Series I Bonds can be a great option as the interest rate adjusts to match inflation. The maximum annual purchase amount is relatively small at $10,000, making them a good tactical addition to a portfolio. My colleague Marty Shields recently wrote a blog covering I-bonds in more detail for interested readers.

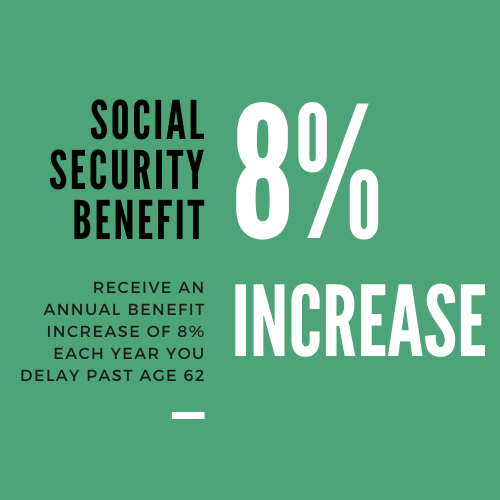

2. Delay Collecting Social Security

Eligible individuals can begin collecting social security benefits once they reach age 62. However, the program incentivizes delaying, by offering 8% increases in benefits for each year past 62 that a retiree delays benefits. The 8% increase is in addition to the annual cost-of-living increases that are determined in part by the Consumer Price Index (CPI). An 8% inflation-adjusted increase in benefits is difficult to find in any investment product, so delaying social security can have an impressive payoff.

For some people, this may mean working a year or two longer than they had planned. For others, it may mean reducing their spending in the short term and/or living off their portfolio or cash in the bank instead of Social Security. It is not always possible to forego retirement income, so this strategy will not work for everyone.

3. Review Monthly Spending

When a paycheck isn’t going as far as it did last year or even last month, every dollar matters. It is a great time to examine the household budget or create one for the first time. Scouring through bank and credit card statements will help identify categories that are consuming more of the monthly cash flow than they should. This exercise may also reveal unnecessary subscriptions that can be canceled or fees that can be avoided by changing behaviors. Budgeting is a prudent financial exercise in any environment, but its importance increases during periods where monthly cash flow may be spread thin.

When a paycheck isn’t going as far as it did last year or even last month, every dollar matters. It is a great time to examine the household budget or create one for the first time. Scouring through bank and credit card statements will help identify categories that are consuming more of the monthly cash flow than they should. This exercise may also reveal unnecessary subscriptions that can be canceled or fees that can be avoided by changing behaviors. Budgeting is a prudent financial exercise in any environment, but its importance increases during periods where monthly cash flow may be spread thin.

4. Avoid Early Payoff of Low-Interest Debt

When inflation is high, each dollar is worth more today than it will be next month, next quarter, or next year. In terms of real dollars, it would be “cheaper” to make debt payments stretched out through future years instead of making extra principal payments in the current year. For example, if a fixed monthly debt payment is $500 today and inflation is 8% for the year, that same monthly payment will only cost $463 in inflation-adjusted dollars next year. An individual would be better off directing current cash flow towards investments or necessary expenses than making extra principal payments on low-interest rate debt.

5. Purchase a Leased Car

For households with a leased vehicle, inflation may make the buy-out option more attractive at the end of the lease period. Used car prices have been impacted more dramatically than some areas of the economy with prices 42.5% above normal levels2. However, the purchase price on a lease is pre-determined by the initial contract, which may appear incredibly cheap now compared to the inflated price of a similar vehicle. Even if the lessee does not intend to keep the car long-term, it may make financial sense to buy it at a lower price and either sell it immediately at a profit or keep it until car prices return to a favorable level.

For households with a leased vehicle, inflation may make the buy-out option more attractive at the end of the lease period. Used car prices have been impacted more dramatically than some areas of the economy with prices 42.5% above normal levels2. However, the purchase price on a lease is pre-determined by the initial contract, which may appear incredibly cheap now compared to the inflated price of a similar vehicle. Even if the lessee does not intend to keep the car long-term, it may make financial sense to buy it at a lower price and either sell it immediately at a profit or keep it until car prices return to a favorable level.

Conclusion

In summary, here are 5 actionable steps to consider combatting inflation on a personal level.

- Invest in equities

- Delay Social Security if possible.

- Stick to a budget.

- Don’t rush to pay down low-interest rate debt early.

- Consider buying a leased vehicle at the end of the leased period.

Watching prices skyrocket can leave individuals feeling helpless and concerned about their personal finances. Implementing the measures and mindsets described in this article can help Americans weather the storm of high inflation and position themselves for long-term success.

If you have any questions on how to protect yourself from the effects of inflation, please feel free to contact one of the advisors at Bouchey Financial Group.

References